USGrant1962

Thinks s/he gets paid by the post

Now that the $1.9T package is destined to become law, Michael Kitces has published one of his usual excellent summaries. This has a good discussion of aspects that are currently scattered among various threads here.

https://www.kitces.com/blog/the-ame...s-checks-and-more-that-advisors-need-to-know/

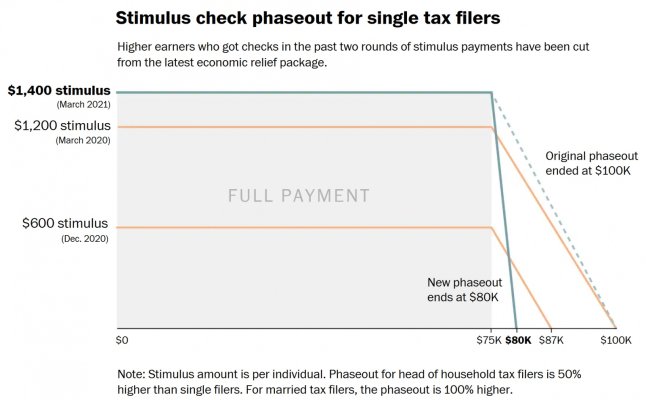

One interesting takeaway - due to the broader application combined with accelerated phase-out of stimulus credits, large families that exceed $150K AGI could face >100% marginal tax rates, not even counting state income taxes. He gives an example where a $150K earner gets a $10K bonus and loses money.

IMO, tax phase-outs and cliffs just suck, generally.

He also discusses the temporary nature of the law - it is supposedly a response to COVID-19, so temporary makes sense.

And the name is the American Rescue Plan Act, so I guess "ARPA". That way we can keep track of which mongo-spending act we are complaining about.

https://www.kitces.com/blog/the-ame...s-checks-and-more-that-advisors-need-to-know/

One interesting takeaway - due to the broader application combined with accelerated phase-out of stimulus credits, large families that exceed $150K AGI could face >100% marginal tax rates, not even counting state income taxes. He gives an example where a $150K earner gets a $10K bonus and loses money.

IMO, tax phase-outs and cliffs just suck, generally.

He also discusses the temporary nature of the law - it is supposedly a response to COVID-19, so temporary makes sense.

And the name is the American Rescue Plan Act, so I guess "ARPA". That way we can keep track of which mongo-spending act we are complaining about.