chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

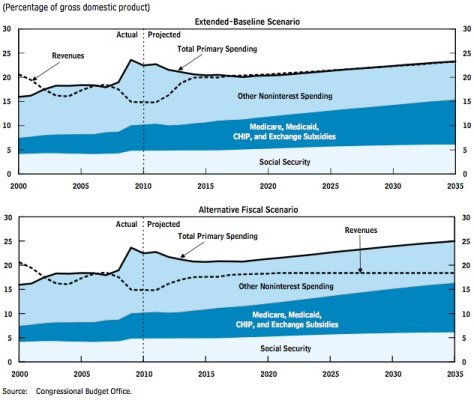

Most of the Politicians and Economic experts that are not playing politics seem to be have a common point of view.... Addressing our deficit and debt will take a combination of shrinking spending and more taxes.

What is not spoken by the "no tax" crowd.... they need (and want) the Bush tax cut extension to expire. Why?

It accomplishes two goals.

So, as usual, the middle class paid the first time (FICA over years), it was spent (because of lower taxes and with no intention of reducing spending by both parties), and now the middle class pays it back.

I like lower taxes as much as the next person... But it sure seems like the middle class is the group getting the short end of the stick!

What is not spoken by the "no tax" crowd.... they need (and want) the Bush tax cut extension to expire. Why?

It accomplishes two goals.

- If there were really drastic cuts to SS and Medicare... many of them would be tossed out... with a vengeance.

- Their favored constituents (extremely wealthy who pay for the lobbyist) made a bundle in the 1980's forward and then even more in the 2000 with the Regan and Bush tax cuts. Because the majority of the benefit went toward the extremely wealthy.

So, as usual, the middle class paid the first time (FICA over years), it was spent (because of lower taxes and with no intention of reducing spending by both parties), and now the middle class pays it back.

I like lower taxes as much as the next person... But it sure seems like the middle class is the group getting the short end of the stick!