ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

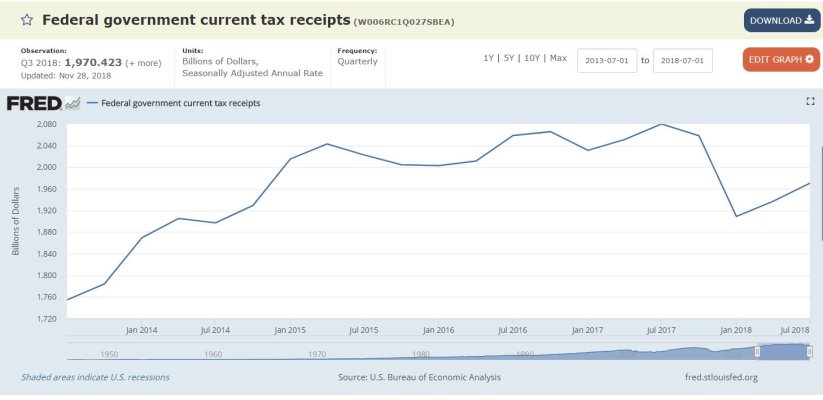

No they're Not !! --- Not sure where you get your news from, but it is completely False! ....2018 Federal tax receipts are at an all time high, so it isn't the tax cuts that are causing the problem. It's the spending.

Looking at your own source/quote, it sure seems to be true. At least according to grade school arithmetic:

.... http://www.crfb.org/blogs/has-revenue-risen-2018

**********************************************************

"While individual income tax receipts have increased in nominal dollars since last fiscal year, ..."

So in what world does "increased in nominal dollars since last fiscal year" make the statement "Federal tax receipts are at an all time high," completely false?

And yes, they are higher than previous years as well, so there is no out there.

It is you who are adding the conditions regarding 'inflation adjusted' and trying to account for sources. That's OK, but it in no way makes Winemaker's statement "completely false".

I've seen this technique in several "Fact Check" sites - they change the quote, adding conditions that they want, and then claim it is false. Drives me nuts. I'm waiting for the fact-checking the fact-checkers site, ad infinitum...

-ERD50