You may think that if you don't have a public Pension, that this won't affect you.

You might be wrong. What drew my attention to the problem, was a local (greater Chicago) news article that pointed our some major real estate tax increases in some suburbs... required to pay pensions to local employees, because their pension funds were under funded... some by as much as 80%.

Very simply, what happened in many locations, is that the pension funds were poorly managed, and long term projections of needs, were based on the belief that interests rates would remain stable... especially bad, when the plans were last reviewed when interest rates were 7%+' Subsequent politicians are naturally reticent about increasing taxes, so as long as there was money in the fund, the draw downs were ignored. Yes... oversimplification, but what happened.

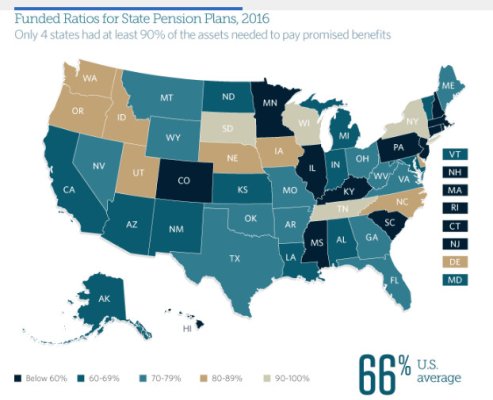

The problem varied by state and by community, so there are vast differences . Here are are some of the states in the worst case analysis. % funded.

1. Kentucky and New Jersey: 31% funded

2. Illinois: 36% funded

3. Connecticut: 41% funded

4. Colorado: 46% funded

5. Hawaii: 51% funded

Here is one of many articles that lays out the problem.

https://money.cnn.com/2018/04/12/retirement/state-pension-funds/index.html

The current fund shortage is estimated to be $1.4 trillion dollars, according to that April 2018 article.

Federal pension problems seem to be solved by simply increasing the federal debt. Local/State communities that are in trouble don't seem to have that same ability.

Here's the article that triggered the concern:

https://www.chicagotribune.com/suburbs/norridge/news/ct-nhh-norridge-pension-tax-increase-tl-1129-story.html

The amount of tax increase may seem minor, but with the decrease in local taxes that comes from closing business, malls, local retail stores etc., unless communities adopt changes, the problems could grow quickly.

Am sure there are different opinions, different takes on this subject.

The door is open.

You might be wrong. What drew my attention to the problem, was a local (greater Chicago) news article that pointed our some major real estate tax increases in some suburbs... required to pay pensions to local employees, because their pension funds were under funded... some by as much as 80%.

Very simply, what happened in many locations, is that the pension funds were poorly managed, and long term projections of needs, were based on the belief that interests rates would remain stable... especially bad, when the plans were last reviewed when interest rates were 7%+' Subsequent politicians are naturally reticent about increasing taxes, so as long as there was money in the fund, the draw downs were ignored. Yes... oversimplification, but what happened.

The problem varied by state and by community, so there are vast differences . Here are are some of the states in the worst case analysis. % funded.

1. Kentucky and New Jersey: 31% funded

2. Illinois: 36% funded

3. Connecticut: 41% funded

4. Colorado: 46% funded

5. Hawaii: 51% funded

Here is one of many articles that lays out the problem.

https://money.cnn.com/2018/04/12/retirement/state-pension-funds/index.html

The current fund shortage is estimated to be $1.4 trillion dollars, according to that April 2018 article.

Federal pension problems seem to be solved by simply increasing the federal debt. Local/State communities that are in trouble don't seem to have that same ability.

Here's the article that triggered the concern:

https://www.chicagotribune.com/suburbs/norridge/news/ct-nhh-norridge-pension-tax-increase-tl-1129-story.html

The amount of tax increase may seem minor, but with the decrease in local taxes that comes from closing business, malls, local retail stores etc., unless communities adopt changes, the problems could grow quickly.

Am sure there are different opinions, different takes on this subject.

The door is open.

Attachments

Last edited: