Wherever you are on the ER continuum, you should be aware of Social Security. Highly recommended to sign on with your own information, as in the future, there may be changes or questions that will apply to you.

You can use the site for any number or needs... to get a replacement SS card, to see your SS record, for 1099's at tax time, and to get records of the intereactions and history of your own record.

Here's the site: https://www.ssa.gov/

.................................................................................

Example... I just looked up my own SS record, and found that between the me and my employers, we had put about $53,000 into SS over the years. Since beginning to collect @ age 62, we have already received between $$400K and $450K (DW & I) We're hoping that it will be around for our kids and their kids.

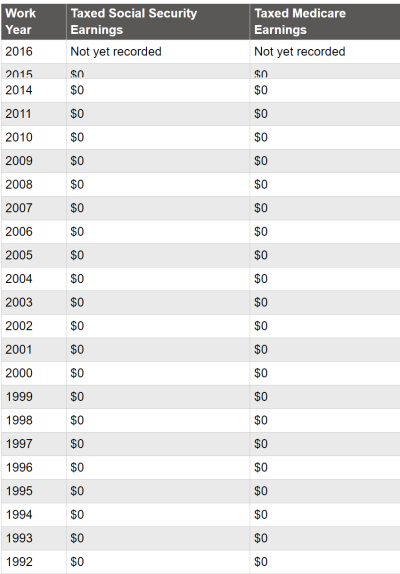

Here's a copy of the record of my payments in to SS since 1992, a few years after we retired.

Just thought to put this important subject into some perspective.

You can use the site for any number or needs... to get a replacement SS card, to see your SS record, for 1099's at tax time, and to get records of the intereactions and history of your own record.

Here's the site: https://www.ssa.gov/

.................................................................................

Example... I just looked up my own SS record, and found that between the me and my employers, we had put about $53,000 into SS over the years. Since beginning to collect @ age 62, we have already received between $$400K and $450K (DW & I) We're hoping that it will be around for our kids and their kids.

Here's a copy of the record of my payments in to SS since 1992, a few years after we retired.

Just thought to put this important subject into some perspective.

Attachments

Last edited: