Isn't the root problem a case of demographics? Because of the baby boom more people are retiring and collecting than ever before. Problem is when demographics swung in the other direction we didn't save the surplus, congress spent it. I should also add that the original social security really was a 'savings program'. However over the years we've added benefits such as support for spouses and dependents. It's not really surprising we are at this point. Hopefully there's a way to fix it.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Social Security (House) Proposal

- Thread starter TickTock

- Start date

- Status

- Not open for further replies.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If it is really "available", the SS trust fund will not be running out of money by 2034. Every extra dipping by folks who did not contribute to the amount is exacerbating the situation, not to mention the unfairness.

How is it "extra dipping" if the statute provides for it?

It is more beneficiaries just taking what the statute provides for like any other government benefit.

If you want to blame Congress for their stupidity then fine, this will be a long and active thread, but why would any beneficiary refuse to accept benefits that Congress has provided for?

No. A spouse doesn't even need to have any SS credits to draw the 50% of the earning spouse. That's double dipping. I know couples personally that are doing just that, with little to none of their own SS credits. Their own SS credits aren't even factored in. They get a benefit based on the working spouse's SS contributions.GenXguy,

No you have it totally wrong and AuduDudi and statsman both had it right. The spousal benefit is the difference between 50% of the PIA of the higher spouse and the lower earning spouse's PIA based on their work record.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

But the deal is that you get benefits for your life and when you die the surviving spouse gets the higher of the two benefits... plan for it!

Most defined benefit pensions operate similalry unless the pensioner has elected the lower paying joint life option and the same with SPIAs. So plan for it!

Most defined benefit pensions operate similalry unless the pensioner has elected the lower paying joint life option and the same with SPIAs. So plan for it!

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

...A spouse doesn't even need to have any SS credits to draw the 50% of the earning spouse. That's double dipping.

Nope, not double dipping. At worst 150% dipping.

But that what the statute provides and what Congress decided to do. I realize that you don't like it but bitching about it here isn't going to change it at all. Get over it and grow up.

No, see above. I know spouses drawing the 50% of the working spouse despite having no or almost no SS credits of their own.No. Totally wrong. See above.

Geesh. This is just a discussion about changes needs to SS, and I'm saying this is a good place to cut back to people receiving unearned benefits that aren't based solely on their work record. I don't care about the current statute - that's what needs changed. lolNope, not double dipping. At worst 150% dipping.

But that what the statute provides and what Congress decided to do. I realize that you don't like it but bitching about it here isn't going to change it at all. Get over it and grow up.

Also SS benefits shouldn't be taxed at all, or they should be indexed to the thresholds set in 1983 based on inflation, as I've mentioned many times.

Feel free not to read my posts. I am sure we will never agree.

Last edited:

I'm talking about how I think it should work with reform - cutting the waste to people that didn't earn the benefits before cutting from those that actually earned it.While I can understand your point of view, that's not really the way it works.

Maybe cut benefits to people with pensions as well.

Even though benefits have bend points, it's still correlated to what you pay in, where a spousal benefit is not - it's just a gift of my tax dollars they didn't earn.

I know exactly how it works and know people who are working the system based on the current law. So if SS needs shored up, I believe the free handouts to those who didn't earn the benefits should be cut first, although I realize that's not going to solve the issue in itself.You lack an understanding of how that works. It is automatic!! So you poor GenX payers are only paying $200/mo more, not $1200 as you would have been paying $1k anyway. Please keep on working and contributing

Ida May Fuller is the one that got the best deal from SS. Feel free to look that one up.

I retired in 2023. I won't colllect SS for quite a few years yet, but I won't be double dipping in my household.

Death benefits have been mentioned multiple times in this thread.No one is mentioning the haircut the surviving spouse takes when one dies. Losing $2k/mo or more can be a serious hit to a lot of senior budgets.

Agreed - absolutely.If it is really "available", the SS trust fund will not be running out of money by 2034. Every extra dipping by folks who did not contribute to the amount is exacerbating the situation, not to mention the unfairness.

Anyway, people on this forum are no where in agreement, so you can see how this issue won't be easily resolved by government.

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Geesh. This is just a discussion about changes needs to SS, and I'm saying this is a good place to cut back to people receiving unearned benefits that aren't based solely on their work record. I don't care about the current statute - that's what needs changed. lol

Also SS benefits shouldn't be taxed at all, or they should be indexed to the thresholds set in 1983 based on inflation, as I've mentioned many times.

Feel free not to read my posts. I am sure we will never agree.

I think I have said more than once that I agree with you and that phasing out the spousal benefit is a good idea, but your incessant bitching about it is very annoying, not to mention your frequent mischaracterization of it.

What in the world would make you think that SS benefits shouldn't be taxed at all. Bad idea. If you have a contributory pension plan only the growth portion of your benefits are taxed as they should be. If you have a non-deductible IRA than the only growth portion of your withdrawals are taxed, as they should be. If you buy a retirement annuity outside of an IRA, the portion of benefits in excess of what you paid is taxed, as it should be. So why should social security, which you contribute to be totally tax free and you don't get taxed on benefits received in excess of contributions! Doesn't make sense. Not to mention it would make the system weaker not stronger, but perhaps that is your ultimate goal.

Last edited:

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,184

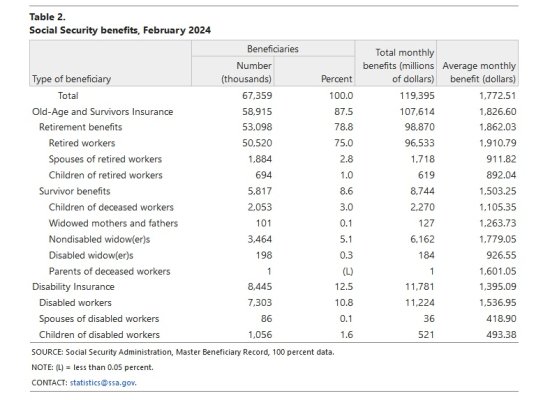

Looks like spouses and children of retired workers are only 6% of the total, and their monthly benefits are substantially less than retired workers. [-]Why do people argue without facts, especially when they’re more readily available than ever?[/-]

https://www.ssa.gov/policy/docs/chartbooks/fast_facts/2023/fast_facts23.pdf

+1

For those who would like to work with lots of numbers, this link has more recent and more detailed SS payout data:

https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/

The attached image shows the latest monthly snapshot data they have, February 2024 (much, much more is available from the above link). From that table, non-survival spousal benefits accounted for about 1.4% of total SS payments for the month. In politician math, usually that does not make noise level.

Attachments

Death benefits have been mentioned multiple times in this thread.

The death benefit is $255 and the person that dies needs 40 quarters. My 1st wife had 39 quarters and did not qualify for the death benefit.

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

... The attached image shows the latest monthly snapshot data they have, February 2024 (much, much more is available from the above link). From that table, non-survival spousal benefits accounted for about 1.4% of total SS payments for the month. In politician math, usually that does not make noise level.

Agreed, plus an educated guess is that percentage is declining as we have more and more two-earner couples. But it gives some people something to bitch about.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You’re welcome to your POV, but repeating yourself dozens of times is pointless, especially with the rest of us providing the facts for you.Geesh. This is just a discussion about changes needs to SS, and I'm saying this is a good place to cut back to people receiving unearned benefits that aren't based solely on their work record. I don't care about the current statute - that's what needs changed. lol

Also SS benefits shouldn't be taxed at all, or they should be indexed to the thresholds set in 1983 based on inflation, as I've mentioned many times.

Feel free not to read my posts. I am sure we will never agree.

As noted above, spousal benefits won’t be among the changes implemented when something is finally done.

VanWinkle

Thinks s/he gets paid by the post

Eliminating income taxes on social security as proposed might be politically popular but is an extremely flawed idea.

It would be better to tax social security like other contributory retirement benefits such as contributory pension benefits, non-deductible IRAs or retirement annuities. The SSA knows what your earnings were each year and therefore your total contributions into the program so they could easily determine what portion of your benefits are return of contributions and how much is from growth.

Or to make it even easier, benefits are tax-free to the extent of contributions and then taxable after that.

SS is not a contribution, it is a premium paid for OAS benefits. By the same logic, proceeds from LTC insurance should also be taxable above your contributions. Life insurance proceeds above your premiums paid should be taxable. It is an insurance program, not a retirement fund.

From the SSA website:

The Social Security trust funds, managed by the Department of the Treasury, are the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) Trust Funds. Since the beginning of the Social Security program, all securities held by the trust funds have been issued by the Federal Government.

Last edited:

SS is not a contribution, it is a premium paid for OAS benefits. By the same logic, proceeds from LTC insurance should also be taxable above your contributions. Life insurance proceeds above your premiums paid should be taxable. It is an insurance program, not a retirement fund.

From the SSA website:

The Social Security trust funds, managed by the Department of the Treasury, are the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) Trust Funds. Since the beginning of the Social Security program, all securities held by the trust funds have been issued by the Federal Government.

This ^^^

Jeffman52

Recycles dryer sheets

My 2C worth.

IMO They should do away with the cap on Salaries that are taxed for SS.

But if they just increase the cap, then they should also have that cap indexed for inflation.

If they do either of these, they should also do away with taxing SS benefits.

On spousal benefits, they should leave it as is. This is in place to protect wives who were homemakers and then their Husbands divorced them, leaving them with nothing and no SS. When people talk about they should only get half, they should consider that leaves these people living in poverty. If SS is barely enough to live on now (for most people), then how is "half" going to be anywhere close?

Someone mentioned this being an issue because of the number of Baby boomers that are now retiring or are retired. True, but that issue is going to continue. 20% of the population are BB, 19% are GenX, 22% are Millennials. etc etc So one population is just going to replace another.

Raising the age of SS. Someone else said it but I will reiterate it. Just because you live longer doesn't mean you CAN work longer. Some due to health, others due to ageism in the workforce.

Lastly, the government (regardless of who is in charge) hasn't found a dollar they don't want to spend. If they do decide to do away with the cap, they will find another cash inlet(for a while) that will just fund more govt, as they take the money, spend it, and write Trust Bonds to SS. Over time they may increase benefits, find creative ways to give it to more people, until we find ourselves right back in the same spot.

IMO They should do away with the cap on Salaries that are taxed for SS.

But if they just increase the cap, then they should also have that cap indexed for inflation.

If they do either of these, they should also do away with taxing SS benefits.

On spousal benefits, they should leave it as is. This is in place to protect wives who were homemakers and then their Husbands divorced them, leaving them with nothing and no SS. When people talk about they should only get half, they should consider that leaves these people living in poverty. If SS is barely enough to live on now (for most people), then how is "half" going to be anywhere close?

Someone mentioned this being an issue because of the number of Baby boomers that are now retiring or are retired. True, but that issue is going to continue. 20% of the population are BB, 19% are GenX, 22% are Millennials. etc etc So one population is just going to replace another.

Raising the age of SS. Someone else said it but I will reiterate it. Just because you live longer doesn't mean you CAN work longer. Some due to health, others due to ageism in the workforce.

Lastly, the government (regardless of who is in charge) hasn't found a dollar they don't want to spend. If they do decide to do away with the cap, they will find another cash inlet(for a while) that will just fund more govt, as they take the money, spend it, and write Trust Bonds to SS. Over time they may increase benefits, find creative ways to give it to more people, until we find ourselves right back in the same spot.

Last edited:

Another informative and useful link, thanks! Policy suggestions based on data are always helpful.+1

For those who would like to work with lots of numbers, this link has more recent and more detailed SS payout data:

https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/

The attached image shows the latest monthly snapshot data they have, February 2024 (much, much more is available from the above link). From that table, non-survival spousal benefits accounted for about 1.4% of total SS payments for the month. In politician math, usually that does not make noise level.

RetiredHappy

Thinks s/he gets paid by the post

- Joined

- Jun 27, 2021

- Messages

- 1,592

How is it "extra dipping" if the statute provides for it?

It is more beneficiaries just taking what the statute provides for like any other government benefit.

If you want to blame Congress for their stupidity then fine, this will be a long and active thread, but why would any beneficiary refuse to accept benefits that Congress has provided for?

Why are you getting all personal over it? It is the statute that provides for double/extra dipping. It is legal and it sucks for taxpayers like myself and my spouse who worked and collect on our own record.

I raised a child and never missed a day of work besides 60 days of maternity leave. Spouses who opted to stay home and not work should not be collecting extra SS. SS benefits for the working spouse should be split between the 2.

Last edited:

FiveDriver

Full time employment: Posting here.

I know exactly how it works and know people who are working the system based on the current law. So if SS needs shored up, I believe the free handouts to those who didn't earn the benefits should be cut first, although I realize that's not going to solve the issue in itself.

Wow. I see this thread went off the rails late last night.

Genx...you've got a lot to learn about the Social Security system. I offered some solid suggestions about how to keep the Fund solvent. Your response was a repetitive rant about double-dips and woeful 'tax' payers.

My wife put in her 40 quarters, and then ran the household which enabled me to maximize my earnings record.

You're certainly entitled to your opinion. But just know that on the 3rd Wednesday of every month, DW will get a Direct Deposit with some of your 'taxes' adding to her payment.

We might even go to our favorite restaurant downtown next month. We'll raise our glasses in a toast to your generosity.

Increase the Wage Base. Raise the Full Retirement Age.

Last edited:

Exit 2024

Recycles dryer sheets

- Joined

- Jun 23, 2015

- Messages

- 414

If anyone interested what options government is considering - here is a link, all grouped by type.

https://www.ssa.gov/oact/solvency/provisions/index.html

Interesting read under section Benefits for Family Members

https://www.ssa.gov/oact/solvency/provisions/index.html

Interesting read under section Benefits for Family Members

If anyone interested what options government is considering - here is a link, all grouped by type.

https://www.ssa.gov/oact/solvency/provisions/index.html

Interesting read under section Benefits for Family Members

Another good link. Thanks!

- Status

- Not open for further replies.

Similar threads

- Replies

- 1

- Views

- 379

- Replies

- 3

- Views

- 347

- Replies

- 6

- Views

- 1K