IndependentlyPoor

Thinks s/he gets paid by the post

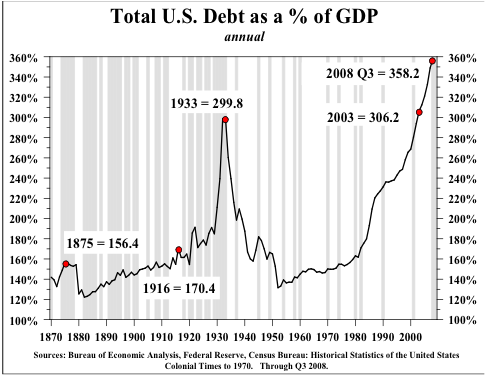

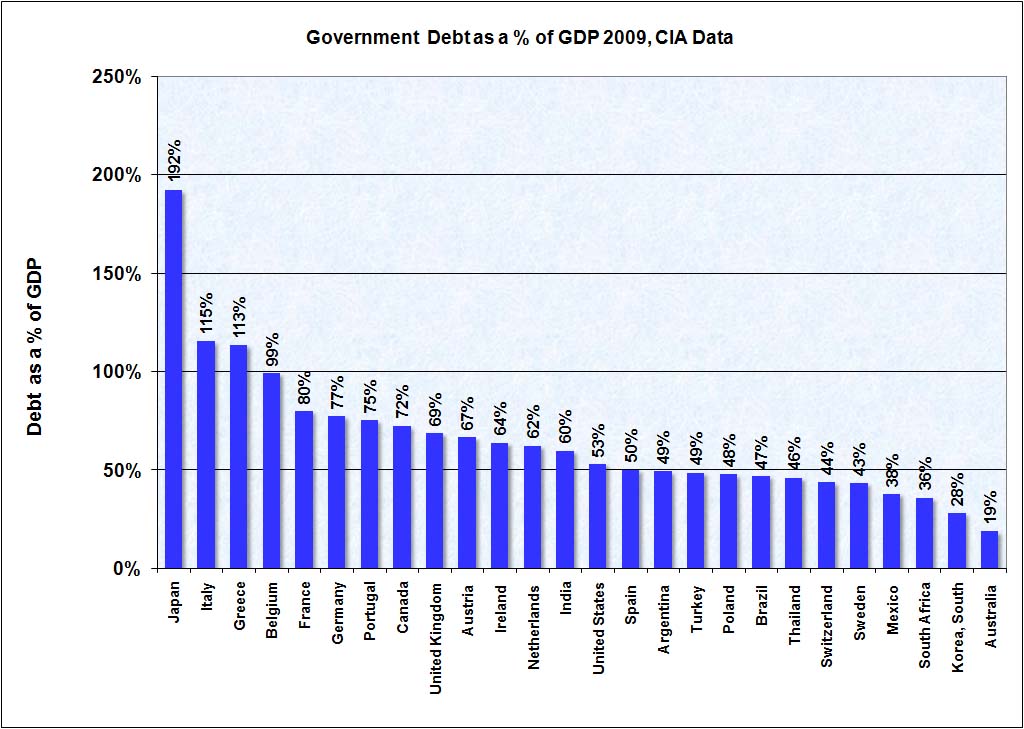

I suspect that we all worry about the national debt. It is easy to imagine it ruining our retirement plans. It is also very satisfying to blame it on the "other side". This chart, via one of my favs, Barry Ritholtz, sheds some interesting data on the argument.