Every time I read an article about the national debt, it always implies that interest on the debt is the issue, but as long as interest rates remain low (which would be implied by low levels of inflation) then we're fine. But what about principal on the debt? Every time we add $1 trillion, isn't that an extra tril that needs to get repaid eventually? Isn't THAT a huge issue even if the debt were interest free?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What about principal on the natl debt??

- Thread starter RenoJay

- Start date

- Status

- Not open for further replies.

This sounds like a policy question so the thread was relocated to the public policy forum.

euro

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2015

- Messages

- 2,335

Every time I read an article about the national debt, it always implies that interest on the debt is the issue, but as long as interest rates remain low (which would be implied by low levels of inflation) then we're fine. But what about principal on the debt? Every time we add $1 trillion, isn't that an extra tril that needs to get repaid eventually? Isn't THAT a huge issue even if the debt were interest free?

Yes, if anyone is planning on ever paying it back... Also remember that the National Debt is not something that is locked in forever at a low interest rate. The debt is a mix of short, medium and longterm bonds that constantly turns over. If we encounter a lengthy high-interest period again, then our massive Principal will crush us. It is bound to happen - only question is "when"?

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Some light reading to find an answer to the unanswerable questions of a nation:

https://www.fiscal.treasury.gov/reports-statements/financial-report/

Public discussion and news articles do little to fully educate the masses about debt. Is it the interest or principal that sinks the carrier of debt?

Chart H on this page shows ratio of debt to GDP (Gross Domestic Product):

https://www.fiscal.treasury.gov/rep.../mda-unsustainable-fiscal-path.html#chartdivh

I suppose the reachable explanation is that we will soon incur more debt than we earn. In our family, if we were on that road, many would advise us to spend less, and work harder. Evidently, we gave the opposite instructions to elected officiaals.

https://www.fiscal.treasury.gov/reports-statements/financial-report/

Public discussion and news articles do little to fully educate the masses about debt. Is it the interest or principal that sinks the carrier of debt?

Chart H on this page shows ratio of debt to GDP (Gross Domestic Product):

https://www.fiscal.treasury.gov/rep.../mda-unsustainable-fiscal-path.html#chartdivh

I suppose the reachable explanation is that we will soon incur more debt than we earn. In our family, if we were on that road, many would advise us to spend less, and work harder. Evidently, we gave the opposite instructions to elected officiaals.

Markola

Thinks s/he gets paid by the post

Hmmm, so many thoughts on what causes our US Gov debt to be so insane

We all seem to agree the debt is too high but can't agree where to cut. I better stop here before getting in trouble.

Cutting spending isn’t the only solution. We could raise revenues to offset our consumption of government services and pay down the debt that way. Unfortunately, however, this country doesn’t do many big, bold and practical things anymore at the national level, because calls to come together and share in the pain to achieve something worthwhile only bring out the lobbyists, who kill any attempts at progress in the dark.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

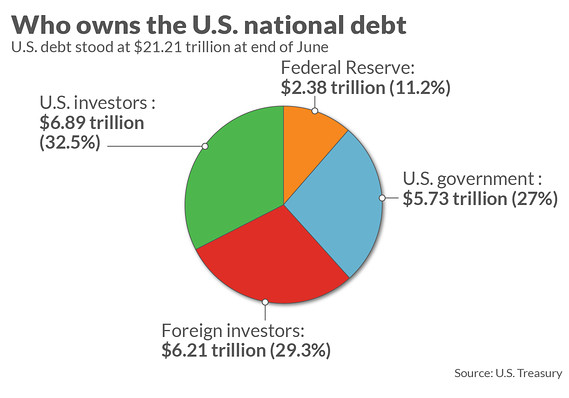

OK, you've followed the money. Now what?So between US and foreign investors, there's people/organizations out there expecting regular interest payments on about 13TT !!

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

Well, for one thing that sort of money contributes to the economy. AND those entities must have a certain amount of influence on the debtor as well as insuring the debtor's success and continuing ability to pay.OK, you've followed the money. Now what?

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

I'm at a loss at what you are trying to say. How does running up the national debt help ensure the continuing ability for the US to pay it off? And what is this influence these lenders have?Well, for one thing that sort of money contributes to the economy. AND those entities must have a certain amount of influence on the debtor as well as insuring the debtor's success and continuing ability to pay.

The influence is primarily on the spending side. Military budget with plenty of campaign money coming from defense contractors. Health care and other public services going to voters who will vote out any politician that makes major cuts, not to mention influence from big pharma and the health care industry. And voters will vote out anyone who introduce major taxes raises to try to pay down the deficit.

There's a lot more to it than that, but blaming the national debt on treasury security holders seems far-fetched to me. I'm here to learn, feel free to educate me, but considering you said you were serious about asking who holds the debt, I doubt you have the answers.

Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

The standard economic response to the principal was that if we could simply keep up with the interest payments, and not add new debt, the principal will shrink as a percent of GDP.

So the debate today is properly about how to stop adding new debt.

So the debate today is properly about how to stop adding new debt.

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

I'm at a loss at what you are trying to say. How does running up the national debt help ensure the continuing ability for the US to pay it off? And what is this influence these lenders have?

The influence is primarily on the spending side. Military budget with plenty of campaign money coming from defense contractors. Health care and other public services going to voters who will vote out any politician that makes major cuts, not to mention influence from big pharma and the health care industry. And voters will vote out anyone who introduce major taxes raises to try to pay down the deficit.

There's a lot more to it than that, but blaming the national debt on treasury security holders seems far-fetched to me. I'm here to learn, feel free to educate me, but considering you said you were serious about asking who holds the debt, I doubt you have the answers.

You're right. I'm out of my league on this and I have no clue! My serious question was about wondering who held the debt; I really didn't know.

IF a significant portion of the debt was held by a narrow set of foreign entities (China?) or a specific set of very large investors, one could argue that they might have a particular interest in preventing us from default and perhaps provide a level of influence over our decision making at a very broad, high level.

The source of my thought process is pretty pedestrian: I was in a bar a few years ago and the President at the time was on the TV scolding China on human rights violations. The Chinese ambassador nodded politely. Someone at the bar said (voicing for the Chinese guy) "Thanks for the update. Just remember that we own you, now go back and make your bond payments to us.

And don't be late!"

It just got me thinking about how, for every debt, there's someone/something out there expecting a payment as income. In a very small way, my bonds--someone's debt--pay me money that I get to spend and send back to the economy.

Am I out in the weeds? Likely. Has happened a lot over my past 67 years. Sorry if I took your time needlessly.

Last edited:

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

You will mostly be cutting if you want to balance the budget. Government spending is outpacing GDP growth. Not to say you can't increase taxes, but your overriding objective is not to kill the economy. Continuing to grow it is key.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

I'm out of my league too. China holding a lot of my debt has me concerned, but I'm not sure how. What's the quote? Something like, "if you owe a bank $100 thousand, they own you. If you owe a bank $100 million, you own them." Does this deter China from starting a war with us, since we clearly wouldn't keep paying them interest or principal on our debt they hold?You're right. I'm out of my league on this and I have no clue! My serious question was about wondering who held the debt; I really didn't know.

IF a significant portion of the debt was held by a narrow set of foreign entities (China?) or a specific set of very large investors, one could argue that they might have a particular interest in preventing us from default and perhaps provide a level of influence over our decision making at a very broad, high level.

The source of my thought process is pretty pedestrian: I was in a bar a few years ago and the President at the time was on the TV scolding China on human rights violations. The Chinese ambassador nodded politely. Someone at the bar said (voicing for the Chinese guy) "Thanks for the update. Just remember that we own you, now go back and make your bond payments to us.

And don't be late!"

It just got me thinking about how, for every debt, there's someone/something out there expecting a payment as income.

BTW, we are paying off some principal, right? Treasuries mature and get paid off. It's not like we're making interest-only mortgage payments. We just take on new debts at a greater rate.

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,427

I'm out of my league too. China holding a lot of my debt has me concerned, but I'm not sure how. What's the quote? Something like, "if you owe a bank $100 thousand, they own you. If you owe a bank $100 million, you own them." Does this deter China from starting a war with us, since we clearly wouldn't keep paying them interest or principal on our debt they hold?

Thanks. That's kind of what I was getting at but you did it in a lot fewer words.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

I also don't think we're making our payments due to pressure from creditors. I think we're making them because if we don't, we'll be downgraded and future credit holders will demand a higher interest rate due to default risk. That's where the death spiral starts, if fewer people are willing to buy our debt or charge more for it.The source of my thought process is pretty pedestrian: I was in a bar a few years ago and the President at the time was on the TV scolding China on human rights violations. The Chinese ambassador nodded politely. Someone at the bar said (voicing for the Chinese guy) "Thanks for the update. Just remember that we own you, now go back and make your bond payments to us.

And don't be late!"

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

There seem to be 2 threads here talking about the same thing. This one implies worrying about it.

http://www.early-retirement.org/forums/f28/when-will-the-machine-stop-98927-2.html#post2273855

http://www.early-retirement.org/forums/f28/when-will-the-machine-stop-98927-2.html#post2273855

Senator

Thinks s/he gets paid by the post

There seem to be 2 threads here talking about the same thing. This one implies worrying about it.

http://www.early-retirement.org/forums/f28/when-will-the-machine-stop-98927-2.html#post2273855

That one was deleted.

That one was deleted.

ER Forum rarely deletes threads. The one in reference is offline and under discussion by the moderator team.

A reminder to members to read the ground rules for discussions in the Public Policy forum, make sure to stay on topic and directly related to early retirement.,

Senator

Thinks s/he gets paid by the post

USD can be printed, in any amount, at any time to pay off the debt. The US will never default on the debt as long as we can print USD.

The Treasury auctions off the bonds, Goldman buys them, and the Fed buys them back at a premium. They are bought and sold on the open market, as required, and then repurchased. There will ALWAYS be someone to buy the bonds, as there is a premium associated with it. It may be China, it may be Goldman. It doesn't matter.

When the US dilutes the money by printing, the entire world pays. Many use the USD as their currency, many use the USD as a payment to other countries. That will not stop anytime soon. Other countries want the USD to be strong. No country wants to have the strongest currency. If the Chinese Yuan became the currency of choice, it would decimate their manufacturing.

Most all other countries print money faster than the US. The theory of relativity is more important than actual nominal amounts.

The World is subsidized by the USD being strong. A strong USD makes foreign goods cheap to people in the USA. Other countries can sell to the USA much easier than the US can sell to other countries. Hence the large Trade (not budget) Deficit.

The USA could simply discard most of the debt/principal without issue. We owe it to ourselves. Even the SS IOUs can be discarded. The money for future obligations comes from the same place that paying the SS Trust fund back comes from.

Inflation is not a worry. Inflation is caused by too much money chasing too few goods. Not printing money. A $15 an hour minimum wage will cause more inflation than printing an extra trillion.

Don't worry, be happy.

The Treasury auctions off the bonds, Goldman buys them, and the Fed buys them back at a premium. They are bought and sold on the open market, as required, and then repurchased. There will ALWAYS be someone to buy the bonds, as there is a premium associated with it. It may be China, it may be Goldman. It doesn't matter.

When the US dilutes the money by printing, the entire world pays. Many use the USD as their currency, many use the USD as a payment to other countries. That will not stop anytime soon. Other countries want the USD to be strong. No country wants to have the strongest currency. If the Chinese Yuan became the currency of choice, it would decimate their manufacturing.

Most all other countries print money faster than the US. The theory of relativity is more important than actual nominal amounts.

The World is subsidized by the USD being strong. A strong USD makes foreign goods cheap to people in the USA. Other countries can sell to the USA much easier than the US can sell to other countries. Hence the large Trade (not budget) Deficit.

The USA could simply discard most of the debt/principal without issue. We owe it to ourselves. Even the SS IOUs can be discarded. The money for future obligations comes from the same place that paying the SS Trust fund back comes from.

Inflation is not a worry. Inflation is caused by too much money chasing too few goods. Not printing money. A $15 an hour minimum wage will cause more inflation than printing an extra trillion.

Don't worry, be happy.

Cichon_007

Dryer sheet wannabe

- Joined

- Jul 26, 2019

- Messages

- 15

1) The United States cannot be forced to default on the debt. We are the sole issuer of our currency, borrow and spend in that currency. Therefore, we cannot "run out" of money. We cannot go bankrupt because there is no bank. Having a monopoly on our currency is why we're different than countries that DO go bankrupt, like Greece, for example.

2) The national debt is an account of all the money spent in to the private sector but not taken out of it via taxes. We can no more "pay off" the debt than you can go back and get the $ you spent on a candy bar when you were 12.

3) The Fed controls interest rates, not the market. If interest payments became too burdensome, guess what? We finance the whole thing in to rolling 6 month Treasuries instead of 30 years, and drop the interest rate to zero.

Wait, WHAT? So if what I'm saying is true then deficits don't matter?

Well, they do and they don't. What matters is the glue that holds the whole thing together. That glue is the productive capacity of the US, the ability to tax that production, and the FAITH in the currency. The US has a lot going for it in those categories.

To the extent that we spend so much that we have a crisis of faith, that's bad. To the extent that we spend on unproductive or mismanaged programs, that's bad. In other words, it's much better to borrow for investment than borrow to fund current consumption.

2) The national debt is an account of all the money spent in to the private sector but not taken out of it via taxes. We can no more "pay off" the debt than you can go back and get the $ you spent on a candy bar when you were 12.

3) The Fed controls interest rates, not the market. If interest payments became too burdensome, guess what? We finance the whole thing in to rolling 6 month Treasuries instead of 30 years, and drop the interest rate to zero.

Wait, WHAT? So if what I'm saying is true then deficits don't matter?

Well, they do and they don't. What matters is the glue that holds the whole thing together. That glue is the productive capacity of the US, the ability to tax that production, and the FAITH in the currency. The US has a lot going for it in those categories.

To the extent that we spend so much that we have a crisis of faith, that's bad. To the extent that we spend on unproductive or mismanaged programs, that's bad. In other words, it's much better to borrow for investment than borrow to fund current consumption.

Cichon_007

Dryer sheet wannabe

- Joined

- Jul 26, 2019

- Messages

- 15

Government spending DOES help the economy. For example, if US Govt kept tax rates the same and then borrowed an extra $1 Trillion and spent it all on fighter jets from Boeing, what happens to GDP?I'm at a loss at what you are trying to say. How does running up the national debt help ensure the continuing ability for the US to pay it off? And what is this influence these lenders have?

The influence is primarily on the spending side. Military budget with plenty of campaign money coming from defense contractors. Health care and other public services going to voters who will vote out any politician that makes major cuts, not to mention influence from big pharma and the health care industry. And voters will vote out anyone who introduce major taxes raises to try to pay down the deficit.

There's a lot more to it than that, but blaming the national debt on treasury security holders seems far-fetched to me. I'm here to learn, feel free to educate me, but considering you said you were serious about asking who holds the debt, I doubt you have the answers.

It increases by $1T.

Not to get too political but that's why Trump's tax cuts and his focus on GDP are silly to me. OF COURSE his policies increased GDP. He took LESS money out of the private sector (cut taxes) while increasing government deficit spending. That shifts the money from the public sector (govt) over to the private sector (GDP).

The problem with doing that is 'some day' the debt-to-GDP ratio gets so high that people lose confidence in the currency. And therefore, deficit spending should go towards things that will raise GDP in the future (ie good investments) rather than only raising it immediately. That's the eventuality that needs to be addressed rather than "paying off" debt.

- Status

- Not open for further replies.

Similar threads

- Replies

- 28

- Views

- 3K

- Replies

- 26

- Views

- 2K

- Replies

- 24

- Views

- 2K