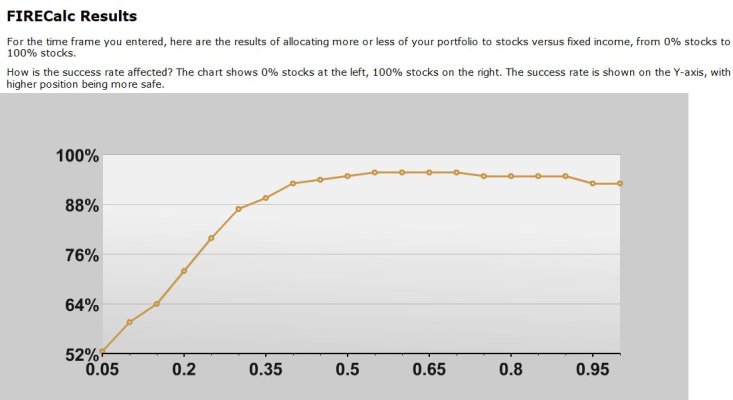

I’m currently at 60/40, but according to this blurb, Jeremy Siegel says 75/25 is now necessary due to low interest rates on bonds. I thought holding 40% allocation in bonds was advantageous so that we could buy more equities during downturns (rather than seeking bond interest as the primary objective). Thoughts?

https://www.cnbc.com/2020/02/08/whartons-jeremy-siegel-60-40-portfolio-doesnt-cut-it-anymore.html

https://www.cnbc.com/2020/02/08/whartons-jeremy-siegel-60-40-portfolio-doesnt-cut-it-anymore.html