harllee

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

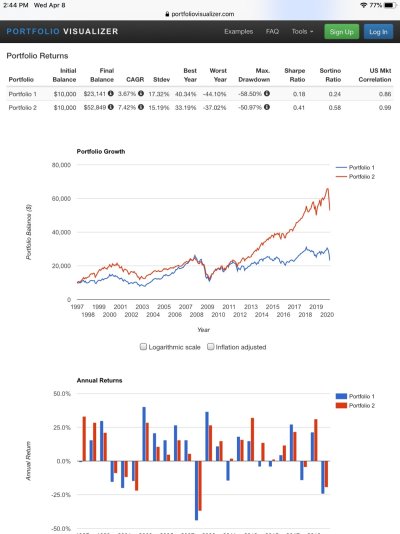

I finally looked at my investments today (had not looked at them in 2 months). I am age 68, retired and have a conservative allocation (40% equities (primarily the Vanguard Total Stock Index Fund)/60% bonds-mm-cds). My investments were "only" down about 7%, I had expected it to be worse. My worse performing assets is my Vanguard International Index Fund which makes up less than 5% of my portfolio. I have never really liked that Fund- it seems like too much risk for the reward but my Vanguard advisor had always said that I needed some international exposure.

What are folks doing about international funds? I am considering moving what I have in the Vanguard International Index Fund to the Vanguard Total Stock Index Fund. Any advice?

What are folks doing about international funds? I am considering moving what I have in the Vanguard International Index Fund to the Vanguard Total Stock Index Fund. Any advice?