I started Medicare Mar 1, and switched our BCBS Non-Obabmacare policy over into my wife's name, with our kids still on it. It all went smooth. The price for those three went up slightly, because of one less person covered.

Yesterday in the mail we (she) got a notice of a 12% rate increase.

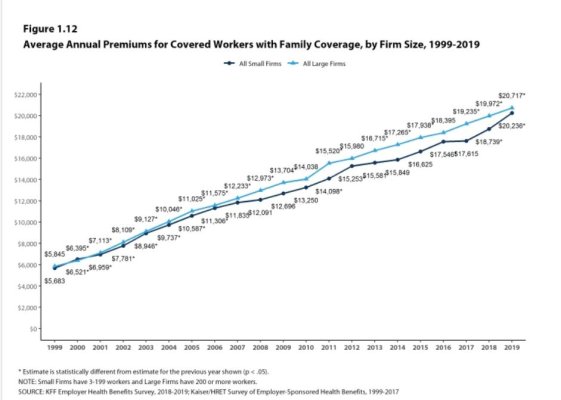

I just don't know how the costs can continue to run 3, 4 or even 12 times

inflation, without a break.

These are my increases since 2010-7.7%, '11' 8.1%, '12'-19.4%, '13'-24%,

'14'-18.8%, '15'-9.2%, '16'-7.1%, ('17', '18', records not found) '19'-5.1% '20'-12%.

The double digit increases were courtesy of Obamacare regulations. Almost a double of my premium in 4 years.

Yesterday in the mail we (she) got a notice of a 12% rate increase.

I just don't know how the costs can continue to run 3, 4 or even 12 times

inflation, without a break.

These are my increases since 2010-7.7%, '11' 8.1%, '12'-19.4%, '13'-24%,

'14'-18.8%, '15'-9.2%, '16'-7.1%, ('17', '18', records not found) '19'-5.1% '20'-12%.

The double digit increases were courtesy of Obamacare regulations. Almost a double of my premium in 4 years.