I was hopping I could get some comments on my fixed income allocation. In the past, before retirement, I just kept all of bond exposure in total bond. A few years ago Vanguard had me move into a few other bond funds. I am now second guessing this and have a feeling I should tinker with this. In the past twenty years I have been very good at staying the course although I recently purchased a three year CD because it was a great rate.

So I am thinking should I not have investment grade bond funds OR should I move my intermediate investment grade bond fund into the short term investment grade bond fund OR should I dump both of those into total bond OR should I just leave everything alone.

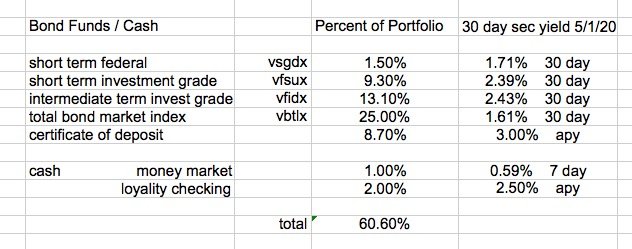

I maintain a 40% equity allocation. All fixed income except the money market and loyalty checking shown below are in tax sheltered accounts. For the rest of this year we will be living off the money market and loyalty checking accounts. In the next 2-3 years we will be living off our taxable account and then rebalancing in the tax deferred accounts to maintain equity allocation.

Any thoughts? Stay the course or tinker? Thanks in advance for any replies.

So I am thinking should I not have investment grade bond funds OR should I move my intermediate investment grade bond fund into the short term investment grade bond fund OR should I dump both of those into total bond OR should I just leave everything alone.

I maintain a 40% equity allocation. All fixed income except the money market and loyalty checking shown below are in tax sheltered accounts. For the rest of this year we will be living off the money market and loyalty checking accounts. In the next 2-3 years we will be living off our taxable account and then rebalancing in the tax deferred accounts to maintain equity allocation.

Any thoughts? Stay the course or tinker? Thanks in advance for any replies.