I would guess this has been banged around before, but a friend of mine was promoting his logic behind a somewhat aggressive AA and withdrawal strategy, which made me pause for a min. His argument was keeping a simple equity/cash bucket system between 80/20 - 90/10 had a higher probability of success long term than say a 60/40, specifically if your 40 holds bonds. His point was average bear markets recover on average of around 3 years so if you pull from your 5 or 3 yr cash bucket during a bear market you should, on average, be fine. Of course, my argument back was what about getting caught in the exceptions... say 2000 or 2008 (8 and 6 yrs to recover, depending what source you use)? Additionally, his point was while equities were more volatile, they clearly have more growth potential and bonds have limited room to move except down in the current interest rate climate. Further, he argued even if you wanted to protect for the worst 8 yr recovery, it would put your AA closer to 70/30. So, does this make a real argument for a long term AA no less than 70/30??

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Another look at AA and withdrawal strategies

- Thread starter DawgMan

- Start date

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Testing theories like this vs history is why FIRECalc was created.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think several folks here use this or very similar approach.

Many are drawn to higher equity exposure because your ending portfolio is likely to be much higher, which is certainly a nice bonus for heirs. This may be particularly appealing to folks that have most of their spending needs covered by SS and pensions.

Others feel like they have more than enough, aren’t looking to leave large funds for heirs, and don’t see the point of taking on more short-term risk for a larger pile at the end.

Different retirees have different goals. It comes down to your goals, so there really is no one-size-fits-all AA.

Many are drawn to higher equity exposure because your ending portfolio is likely to be much higher, which is certainly a nice bonus for heirs. This may be particularly appealing to folks that have most of their spending needs covered by SS and pensions.

Others feel like they have more than enough, aren’t looking to leave large funds for heirs, and don’t see the point of taking on more short-term risk for a larger pile at the end.

Different retirees have different goals. It comes down to your goals, so there really is no one-size-fits-all AA.

Last edited:

atmsmshr

Full time employment: Posting here.

When I was working and with a fairly secure income, pedal to the metal and nearly 100% stocks for 32 years. Now that I am drawing down and more acutely aware of Sequence of Returns Risk, allocation is much more conservative, with a plan for an increasing equity glidepath.

As said before, different goals for different people - and add that the goals and risk tolerance change with circumstance.

As said before, different goals for different people - and add that the goals and risk tolerance change with circumstance.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

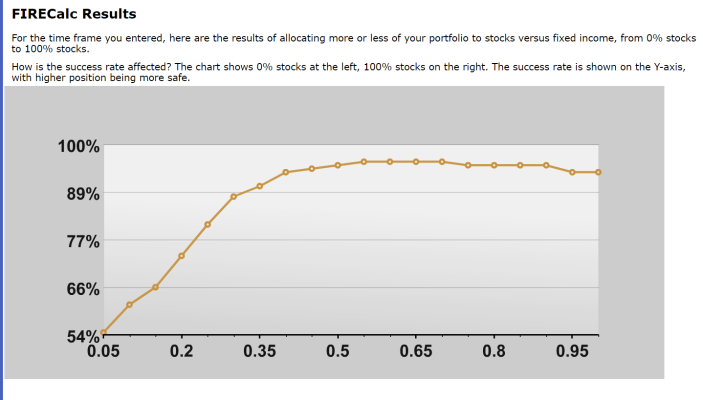

Here's what FIRECalc says:

90/10:

80/20:

60/40:

90/10:

FIRECalc looked at the 120 possible 30 year periods in the available data, starting with a portfolio of $750,000 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 120 cycles. The lowest and highest portfolio balance at the end of your retirement was $-507,733 to $5,193,687, with an average at the end of $1,780,352. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 6 cycles failed, for a success rate of 95.0%.

80/20:

FIRECalc looked at the 120 possible 30 year periods in the available data, starting with a portfolio of $750,000 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 120 cycles. The lowest and highest portfolio balance at the end of your retirement was $-360,375 to $4,560,354, with an average at the end of $1,526,646. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 6 cycles failed, for a success rate of 95.0%.

60/40:

FIRECalc looked at the 120 possible 30 year periods in the available data, starting with a portfolio of $750,000 and spending your specified amounts each year thereafter.

Here is how your portfolio would have fared in each of the 120 cycles. The lowest and highest portfolio balance at the end of your retirement was $-204,356 to $3,423,674, with an average at the end of $1,066,111. (Note: this is looking at all the possible periods; values are in terms of the dollars as of the beginning of the retirement period for each cycle.)

For our purposes, failure means the portfolio was depleted before the end of the 30 years. FIRECalc found that 5 cycles failed, for a success rate of 95.8%

I think several folks here use this or very similar approach.

Many are drawn to higher equity exposure because your ending portfolio is likely to be much higher, which is certainly a nice bonus for heirs. This may be particularly appealing to folks that have most of their spending needs covered by SS and pensions.

Others feel like they have more than enough, aren’t looking to leave large funds for heirs, and don’t see the point of taking on more short-term risk for a larger pile at the end.

Different retirees have different goals. It comes down to your goals, so there really is no one-size-fits-all AA.

I think he was coming from the angle of it's the "safest" and most prudent approach and and offers a higher probability of success if you buy into pulling from that cash bucket and ignoring your equity volatility during the bear market recovery cycle. In other words, being say more conservative than 70/30 with bonds as part of your portfolio is arguably riskier due to the higher probability of the drag of bonds on the over all portfolio, regardless of plans to leave money behind or not. I am not making an argument for or against his position, just putting it out there for discussion.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

I’m almost there at 64/9/27 age 53. Got enough cash to last until SS and pensions start. This year replaced most of our bonds with cash.

This fits well for our situation as all of the stock funds are discretionary spending.

This fits well for our situation as all of the stock funds are discretionary spending.

and then there is this, that to me suggests that between 50/50 and 90/10 that AA doesn't influence success vary much... but it does influence ending values for instances where the plan is successful.

I suppose where his argument differs some with FIREcalc is I believe FIREcalc assumes re-balancing every year. His point was once you are withdrawing your assets, you will have refill bucket rules based on how the equities perform.

Eg: AA of 8/20 (5 year cash bucket is your 20)

Scenario 1: Bear market that takes 5 yrs to recover... he is pulling cash each year and letting equities ride so no re-balancing and his AA effectively goes to 100% equities after which he starts replenishing his 5 yr bucket since the market is recovering.

Scenario 2: Bull market... spend dividends/interest first before touching cash bucket keeping cash bucket refilled as market grows.

Scenario 3: Mix of Bull and Bear... combo of the above.

Again, just putting it out there as another approach.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think he was coming from the angle of it's the "safest" and most prudent approach and and offers a higher probability of success if you buy into pulling from that cash bucket and ignoring your equity volatility during the bear market recovery cycle. In other words, being say more conservative than 70/30 with bonds as part of your portfolio is arguably riskier due to the higher probability of the drag of bonds on the over all portfolio, regardless of plans to leave money behind or not. I am not making an argument for or against his position, just putting it out there for discussion.

That is an approach that I have sometimes thought about but never bothered to try to model.... so for example, if your target is 90/10 and let's say that you rebalance annually in December... if you had a decision rule that if in December your stocks exceed 90% that you withdraw any excess up to your withdrawal and if there is still excess then your rebalance to 90/10, but if in December your stocks are less than 90% you leave the stocks alone and withdraw from bonds.

So in other words, in good times you withdraw from stocks and rebalance but in bad times you withdraw from bonds. I think it would be "sort of" like a bucket system.

I think several folks here use this or very similar approach.

Others feel like they have more than enough, aren’t looking to leave large funds for heirs, and don’t see the point of taking on more short-term risk for a larger pile at the end.

Different retirees have different goals. It comes down to your goals, so there really is no one-size-fits-all AA.

i like the "if you've won the game why keep playing" adage. Every year afrer RMD withdrawls, the taxes are paid and remainder goes to cash and/or CDs.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think he was coming from the angle of it's the "safest" and most prudent approach and and offers a higher probability of success if you buy into pulling from that cash bucket and ignoring your equity volatility during the bear market recovery cycle. In other words, being say more conservative than 70/30 with bonds as part of your portfolio is arguably riskier due to the higher probability of the drag of bonds on the over all portfolio, regardless of plans to leave money behind or not. I am not making an argument for or against his position, just putting it out there for discussion.

That’s his opinion. Ignoring equity volatility is very very difficult to do during bear markets, which many retirees discover to their chagrin at the worst of times. And some make panicky decisions to suddenly change to a lower equity allocation even after a big loss because they realize how uncomfortable they feel. Not to mention that long term portfolio growth, once retired, is not the only consideration.

Describing a lower allocation to bonds and cash as “safer” - that’s a stretch, IMO. People always think they know what is going to happen with interest rates and position short-term accordingly, but are usually surprised year in and year out. The rest of us simply rebalance. Also, some folks are focused on the higher growth long term, others are focused less volatility short-term. Many deliberately choose to strike a particular balance between the two when they choose their AA.

I don’t worry about “drag” of bonds or cash because our portfolio is large enough to support our inflation-adjusted needs according to the models. IMO if the models say your retirement survival rates are very good given your retirement situation, then that’s safe enough.

Last edited:

VanWinkle

Thinks s/he gets paid by the post

I'm not in the high equity allocation camp at 50/50. I do worry about the distaste being shown for bonds. In my portfolio, bonds are for protection from large equity tumbles. The last 2 years, including this year to date, my intermediate bond funds have a total return of 10% and 6.5%. Some people were saying to get out of bonds 2 years ago as the returns were to be minimal or even negative. Will I someday lose principle in bond funds? Yes. The same can be said for most other investments, except a pile of zero interest cash.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I like fixed income but am wary of bonds at this juncture.... bonds seem to be a combination of low yields or high credit risk in a recession and a boatload of interest rate risk (the flip side of most of the 10% and 6.5% return of the last couple years).

I prefer CDs at this point.... no credit risk and no interest rate risk and slightly higher yields.

I prefer CDs at this point.... no credit risk and no interest rate risk and slightly higher yields.

VanWinkle

Thinks s/he gets paid by the post

I like fixed income but am wary of bonds at this juncture.... bonds seem to be a combination of low yields or high credit risk in a recession and a boatload of interest rate risk (the flip side of most of the 10% and 6.5% return of the last couple years).

I prefer CDs at this point.... no credit risk and no interest rate risk and slightly higher yields.

How long ago did bonds seem to be a combination of low yields or high credit risk in a recession and a boatload of interest rate risk............

Nothing against CD's as I think they are a fine alternative for income, not so much for positive ballast in a down market.

Best to you,

VW

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

How can they not be positive ballast in a down market? They just bumble along and earn interest... 3% in my case.

Just a reminder, bonds don't always zig when stocks zag.... the fact that they don't do that reliably any longer are part of why I prefer CDs... I know what CDs are going to do... bonds, not so much.

Just a reminder, bonds don't always zig when stocks zag.... the fact that they don't do that reliably any longer are part of why I prefer CDs... I know what CDs are going to do... bonds, not so much.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I like fixed income but am wary of bonds at this juncture.... bonds seem to be a combination of low yields or high credit risk in a recession and a boatload of interest rate risk (the flip side of most of the 10% and 6.5% return of the last couple years).

I prefer CDs at this point.... no credit risk and no interest rate risk and slightly higher yields.

Same here, but if there is another beginning of a large down leg in stocks, might jump into 30 year treasuries for a short period.

There is little question that--if the goal is inheritance to heirs or, probably, higher spending down the line--the higher equity allocation likely will result in a higher estate or higher spending (like long-term/memory care) over 20-30 years, as Old Shooter and others note.

But I'm most concerned about the next 4 years before full SS, so I've used a gliding path and decreased the stock allocation from 60-65% to 45% over the last 2 years. The market kept running in late 2019 and early 2020, so I kept scraping to lower the stock allocation, which was interesting.

Once I hit SS, I will raise the stock allocation, eventually back to 65% when DW can claim full SS (in 8 years). That's just me, though; it's clear that if I/we weather the next 4 years without too much of a scar, we safely can both withdraw more and increase stock allocation, likely even in an '08 event. For many of you, like those withdrawing 2.5% or less, none of this would matter; circumstances matter to the AA.

February/March was a dry run/test; luckily I had scraped 1/2 of 2019 gains from Nov-early February. I didn't do much other than harvesting tax losses in the brokerage account in March, shifting from one CEF to another, although I did sell some higher risk holdings like small-caps and emerging markets at the end of the 3rd week of February.

I do need to shove a chunk of the cash pile into short-term bonds though, or even some CDs, or I'm giving up 5-7k/year. I've been lazy.

But I'm most concerned about the next 4 years before full SS, so I've used a gliding path and decreased the stock allocation from 60-65% to 45% over the last 2 years. The market kept running in late 2019 and early 2020, so I kept scraping to lower the stock allocation, which was interesting.

Once I hit SS, I will raise the stock allocation, eventually back to 65% when DW can claim full SS (in 8 years). That's just me, though; it's clear that if I/we weather the next 4 years without too much of a scar, we safely can both withdraw more and increase stock allocation, likely even in an '08 event. For many of you, like those withdrawing 2.5% or less, none of this would matter; circumstances matter to the AA.

February/March was a dry run/test; luckily I had scraped 1/2 of 2019 gains from Nov-early February. I didn't do much other than harvesting tax losses in the brokerage account in March, shifting from one CEF to another, although I did sell some higher risk holdings like small-caps and emerging markets at the end of the 3rd week of February.

I do need to shove a chunk of the cash pile into short-term bonds though, or even some CDs, or I'm giving up 5-7k/year. I've been lazy.

Last edited:

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

^^^ one thing that you might consider is to bifurcate your portfolio into a SS bridge (with a CD ladder) and then invest the remainder more aggressively (65/35 or whatever AA is aggressive for you. It may be that combined portfolio is 45/55 or whatever your current AA is, but it is just another way to skin the cat.

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,183

One problem with the theory (AAs with high stock allocations) is the "human" factor practice when markets do go down. Few seem to model what their portfolio would look like, in currency terms, when stocks fall by 30, 40, 50% or more. AA becomes good in their abstract, but when they see in a down market a high currency loss (e.g. several hundred thousand dollars or more), it becomes a shock to them, and they may well panic.

I would guess this has been banged around before, but a friend of mine was promoting his logic behind a somewhat aggressive AA and withdrawal strategy, which made me pause for a min. His argument was keeping a simple equity/cash bucket system between 80/20 - 90/10 had a higher probability of success long term than say a 60/40, specifically if your 40 holds bonds. His point was average bear markets recover on average of around 3 years so if you pull from your 5 or 3 yr cash bucket during a bear market you should, on average, be fine. Of course, my argument back was what about getting caught in the exceptions... say 2000 or 2008 (8 and 6 yrs to recover, depending what source you use)? Additionally, his point was while equities were more volatile, they clearly have more growth potential and bonds have limited room to move except down in the current interest rate climate. Further, he argued even if you wanted to protect for the worst 8 yr recovery, it would put your AA closer to 70/30. So, does this make a real argument for a long term AA no less than 70/30??

Lots of pieces to this one:

For some bucket approaches, there are many who think this is "mental accounting" that offers no long term difference vs withdrawing from both stocks and bonds - but it does allow people to sleep at night. The part that is often argued about is how do you decide when the storm has started and when the storm is over and you can go back to your previous stock/bond balance?

There's also one published systematic approach called "Prime Harvesting" which has you only withdrawing from bonds until your stock holdings reach 1.2X the original holdings, at which point you sell 20% of your stocks and purchase bonds. This, and other methods, are discussed in gory detail on the "Early Retirement Now" website:

https://earlyretirementnow.com/2017...ock-bond-allocation-through-prime-harvesting/

As others have noted, there really is no one-size-fits all AA nor one size fits all withdrawal method. And oftentimes, "more optimal" can mean "more complex" and you have to ask yourself whether you want to deal with the complexity when you get older? Lots of things to consider.

Cheers

Last edited:

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

One problem with the theory (AAs with high stock allocations) is the "human" factor practice when markets do go down. Few seem to model what their portfolio would look like, in currency terms, when stocks fall by 30, 40, 50% or more. AA becomes good in their abstract, but when they see in a down market a high currency loss (e.g. several hundred thousand dollars or more), it becomes a shock to them, and they may well panic.

A good point. People can and will panic and end up selling low when stocks hit the skids. I know several people who have put a chunk of cash into SPIAs not only for the guaranteed payments, but partly as a psychological buffer to keep them from panicking. No, I am not recommending an annuity for all. Though,in my case my SPIA substitute is taking SS at 70. That is enough of a monthly payment to pay the rent, put food on the table and keep the lights on.

Similar threads

- Replies

- 14

- Views

- 1K

- Replies

- 24

- Views

- 2K

Latest posts

-

-

-

What new series are you watching? *No Spoilers, Please*

- Latest: sengsational

-

-

-

-

-

-