Since retiring in 2010 I have been receiving a standard pension from my ex-employer in the USA reported on a 1099-R plus a SERP.

https://www.investopedia.com/terms/s/serp.asp

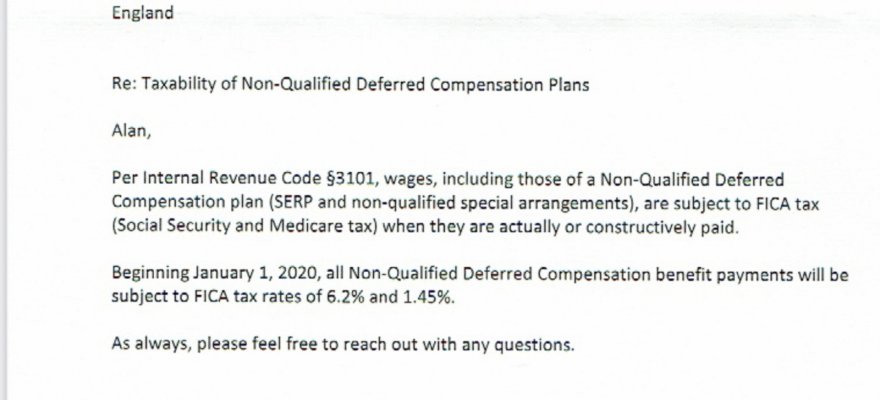

Through 2019 the SERP has been reported on a W-2 in which the gross payment was recorded in box 1 as per regular W-2s, but boxes 3 and 5 were blank so no FICA or Medicare taxes. At the end of 2019 I received a letter from my employer saying that as per IRS code 3101 that ongoing my non-qualified pension (SERP) would now be subject to FICA. Fair enough I thought, I’ve had a 10 year run and the FICA payments will increase by SS and lower the WEP when I start to take it, due to my UK pensions as I only had 23 years of SS payments when I retired.

I received my W-2 this year and now box 1 is blank and boxes 3 and 5 have the gross payments so I have had no income tax withholding but have paid FICA and Medicare. Importing this into TurboTax now means I am paying no taxes on this and that can’t be right. I’ve asked payroll to look into this and their response was that this was what ADP have done on receipt of the new instructions from the IRS and they will ask ADP to investigate further. That was 2 weeks ago and no response back from ADP yet.

At the end of the day I don’t actually pay US taxes on this as I take a foreign tax credit on the UK tax I pay to reduce it to zero anyway. Has anyone ever come across a W-2 with no taxable income or any idea why ADP would have done this due to IRS code 3101?

https://www.investopedia.com/terms/s/serp.asp

Through 2019 the SERP has been reported on a W-2 in which the gross payment was recorded in box 1 as per regular W-2s, but boxes 3 and 5 were blank so no FICA or Medicare taxes. At the end of 2019 I received a letter from my employer saying that as per IRS code 3101 that ongoing my non-qualified pension (SERP) would now be subject to FICA. Fair enough I thought, I’ve had a 10 year run and the FICA payments will increase by SS and lower the WEP when I start to take it, due to my UK pensions as I only had 23 years of SS payments when I retired.

I received my W-2 this year and now box 1 is blank and boxes 3 and 5 have the gross payments so I have had no income tax withholding but have paid FICA and Medicare. Importing this into TurboTax now means I am paying no taxes on this and that can’t be right. I’ve asked payroll to look into this and their response was that this was what ADP have done on receipt of the new instructions from the IRS and they will ask ADP to investigate further. That was 2 weeks ago and no response back from ADP yet.

At the end of the day I don’t actually pay US taxes on this as I take a foreign tax credit on the UK tax I pay to reduce it to zero anyway. Has anyone ever come across a W-2 with no taxable income or any idea why ADP would have done this due to IRS code 3101?