Accidental Retiree

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2012

- Messages

- 1,500

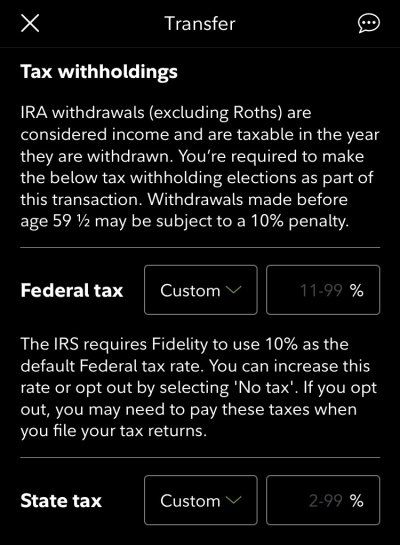

I calculate our safe harbor amount, 110% of last year's taxes -- both federal and state. In early December I then withdraw that amount from the IRAs with 100% withholding.*

Never a reason to estimate anything unless the safe harbor amount makes you unhappy. No reason to pay them prior to December if you can pay it as withholding from an IRA.

*Actually slightly less than 100% because Schwab won't do 100.0%. But close enough.

That’s what we do now, although. I’ve also withheld taxes from my pension.

Last edited: