ER_Hopeful

Recycles dryer sheets

Had a HSA brokerage acct with TDAmeritrade, the acct was rolled over directly to Fidelity last year, all equities were liquidated so I had some capital gains. The fund went straight to Fido.

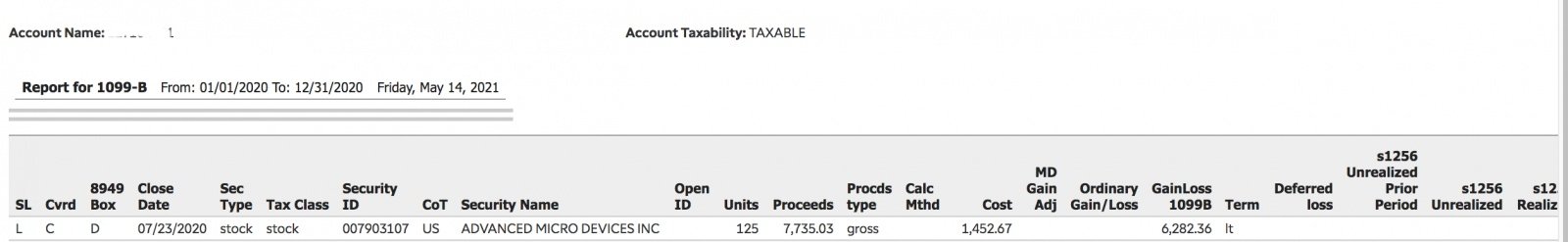

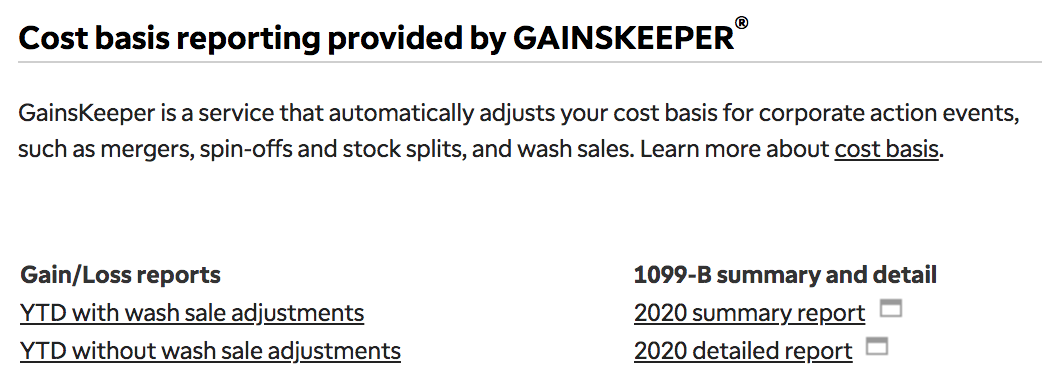

Doing my tax own tax now (HH Block software) and I just manually downloaded a report for 1099-B from TDAmeritrade, it says the gains are taxable and reported to IRS. Is this normal or is that a mistake by TDAmeritrade? How should I file these gains?

I live in CA so capital gains in HSA are taxable but not at the federal level though.

see screenshot of 1099-B

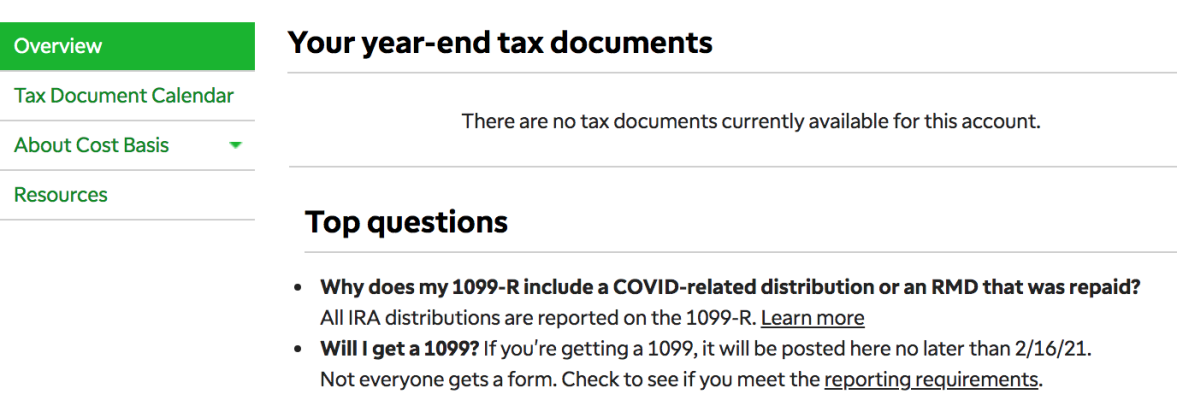

BTW, I don't think I receive a paper 1099-B and when I talked to their rep, she said she didn't see a 1099-B either. Not sure if this makes any difference.

Doing my tax own tax now (HH Block software) and I just manually downloaded a report for 1099-B from TDAmeritrade, it says the gains are taxable and reported to IRS. Is this normal or is that a mistake by TDAmeritrade? How should I file these gains?

I live in CA so capital gains in HSA are taxable but not at the federal level though.

see screenshot of 1099-B

BTW, I don't think I receive a paper 1099-B and when I talked to their rep, she said she didn't see a 1099-B either. Not sure if this makes any difference.

Attachments

Last edited: