I handle the RMD's for my 89 year old mother who is still as sharp as a tack. About 60% of her NW is in a tIRA so her distributions are relatively substantial. She always wants to take the RMD in full in January. Her money her choice. In any event I just looked at the RMD tables for 2022 in preparation of effectuating some sales to make the distribution next month.

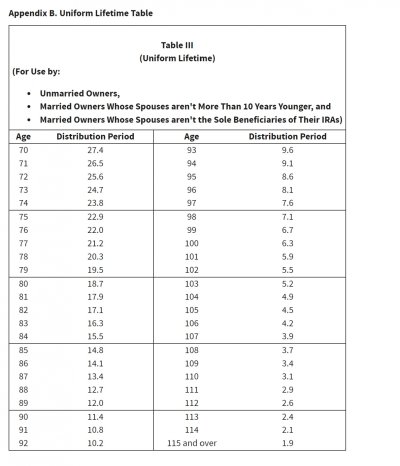

FYI: I didn't realize that the Tables were revised for 2022 to reflect the Secure Act and revised mortality tables. The result is that her RMD for 2022 was about 20% less than the RMD for 2021. This was good news for her.

FYI: I didn't realize that the Tables were revised for 2022 to reflect the Secure Act and revised mortality tables. The result is that her RMD for 2022 was about 20% less than the RMD for 2021. This was good news for her.