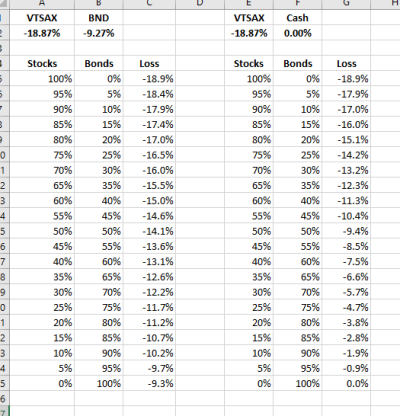

Could use some reassurance or consolation tho i presume many share my pain.. As a freelance sole proprietor Having 'semi-retired' more or less (scaled back a lot on work) in the last year or so I watched 50/50 moderate PF reach its all -time high valuation in late 2020 in the realm of 2.4M. Subsequently YTD the slow tedious daily grind downward is testing my tolerance. With zero debt a modest annual spending level in the realm of 45-50 My investment assets as of today are approaching a loss of 260k YTD., i.e., nearing -11%. On a positive note dividends do generate about 50-55k/year. FWIW, SS will likely be 22k/year-ish, if I wait til 66-67. Firecalc seems to suggest I shouldn't worry much using several different variations of portfolio composition.

I made the error of going too conservative too early for my age and never fully getting back into equities after jumping out of the chaos of 2008-09. My chief question is realistically just how much further this sell-off is likely to go...and for planning purposes, what kind of timeframe folks similarly allocated are anticipating for a reversal and how many years I may be looking at to 'get back to even.' An FA friend suggests if I don't need the $$ in the next five years, i should be okay...it's just the ultimate in s*tty timing when a bear market forms right at the outset of ones traditional retirement age.

Thanks!

Mike

I made the error of going too conservative too early for my age and never fully getting back into equities after jumping out of the chaos of 2008-09. My chief question is realistically just how much further this sell-off is likely to go...and for planning purposes, what kind of timeframe folks similarly allocated are anticipating for a reversal and how many years I may be looking at to 'get back to even.' An FA friend suggests if I don't need the $$ in the next five years, i should be okay...it's just the ultimate in s*tty timing when a bear market forms right at the outset of ones traditional retirement age.

Thanks!

Mike