Graybeard

Full time employment: Posting here.

- Joined

- Aug 7, 2018

- Messages

- 597

First of all, I never sold a T bill. Looking at Vanguard's secondary market right now and I am LOST!

My T bill is CUSIP 912796-ZY-8 bought at auction if this helps. It is a 1 year bill due 1/25/24, annual yield is 4.692% and I bought $75k in my IRA so there are no tax consequences re the profit.

If I sell this do I get the interest it earned plus the sale price or just the sale price and then I calculate my profit from the $71,610.25 I paid for it?

Can you buy/sell outside of market open hours?

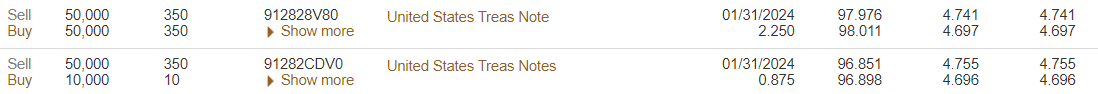

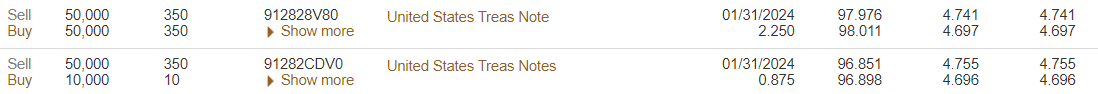

There are just 2 bills close to my maturity date for comparison both mature 1/31/2024. Column 6 is bid/ask, YTW then YTM.

Do I set the bid/ask?

Is the profit selling this worth it considering I can get a 5% or 5.05% 1 year CD?

I am sure I have another 100 questions but let's start here.

Thank you.

My T bill is CUSIP 912796-ZY-8 bought at auction if this helps. It is a 1 year bill due 1/25/24, annual yield is 4.692% and I bought $75k in my IRA so there are no tax consequences re the profit.

If I sell this do I get the interest it earned plus the sale price or just the sale price and then I calculate my profit from the $71,610.25 I paid for it?

Can you buy/sell outside of market open hours?

There are just 2 bills close to my maturity date for comparison both mature 1/31/2024. Column 6 is bid/ask, YTW then YTM.

Do I set the bid/ask?

Is the profit selling this worth it considering I can get a 5% or 5.05% 1 year CD?

I am sure I have another 100 questions but let's start here.

Thank you.