1. Be born to a rich grandma and rich parents that give you stock and $$$ for Christmas gifts.

2. Hold those investments for many years.

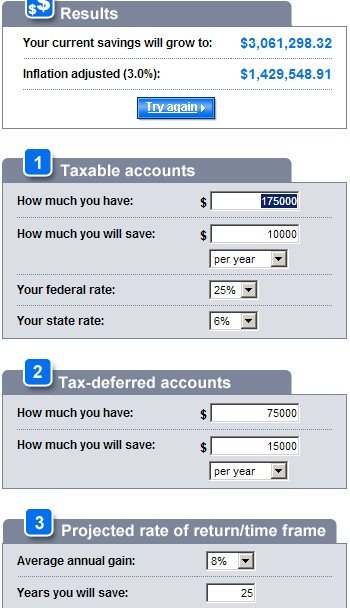

3. Max out your 401k

4. Max out your Roth IRA

5. Live below your means

6. Donate to charity or help others in need

7. Get lucky

8. Keep most of your cash in money market accounts, rather than checking accounts or under your mattress.

9. Buy index funds

10. Diversify

11. Find the asset allocation that works for you. I'm about 78% stocks (individual stocks, S&P 500, Wilshire 5000, International Funds), 2% bonds, 20% money market accounts.

12. Find cheap hobbies. Instead of golf, I play frisbee golf. Cost for frisbees, $25. Cost of playing $0. Having fun with my friends while getting some light exercise......priceless.

13. Help others meet their financial goals.

When I graduated college and began my first job in civil service in February 2003, I had a net worth of $107,000. All of that money had been given to me and I never spent a dime of it. Between February 2003 and today, I received an additional $25,000 in cash gifts from my parents and grandma. Now I will admit that I didn't make all my money the hard way, by earning it, but I've been very fiscally responsible in preserving my capital. I know I earned at least $45,000 all by myself because I have that amount in my 401k and it all came from working for civil service for almost 4 years.