TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

The 17-year-old sax player in my group is off to college, and I wanted to get him a book that could push him in the right direction, money-management-wise. So I checked out The Motley Fool Investment Guide for Teens: 8 Steps to Having More Money Than Your Parents Ever Dreamed Of from the library to evaluate it.

It's a good book. It covers all the kinds of things that most of us find important to get a across: The power of compounding, LBYM but not so much that you feel deprived, handling credit cards, stock market is best in the long run, etc.

It's written in a style that a teenager is likely to read, although the critical first pages could have been a little more cool and engaging. It has a lot of sidebars from teens, relating their actual experiences (how I lost money day trading, etc.).

The only downside is that the last third of the book is about investing directly in stocks. I'd rather that they had stopped at the point where they say "investing in index funds is good."

Here's the table of contents:

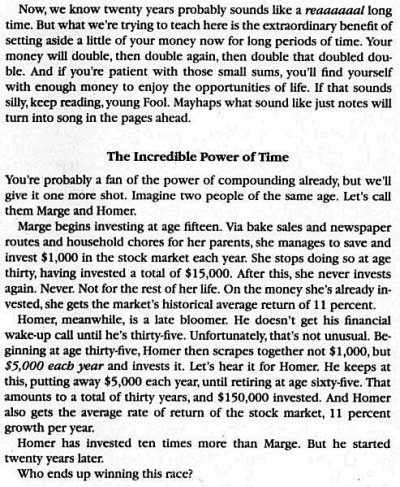

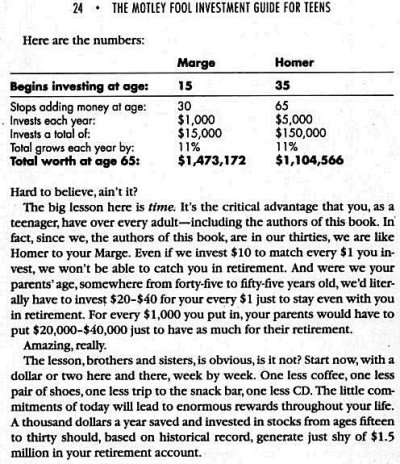

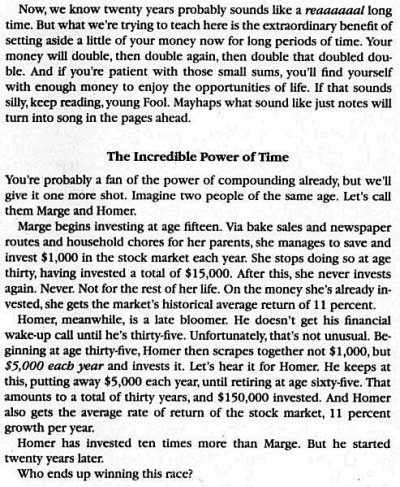

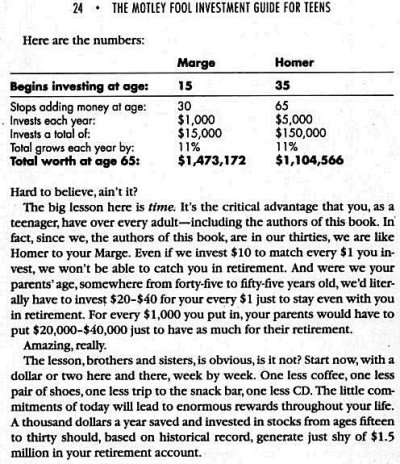

And here's a sample passage that explains a good example of the power of compounding:

-----------------------------

Bottom line: I recommend the book, and will buy one for the sax player, and one for my daughter.

It's a good book. It covers all the kinds of things that most of us find important to get a across: The power of compounding, LBYM but not so much that you feel deprived, handling credit cards, stock market is best in the long run, etc.

It's written in a style that a teenager is likely to read, although the critical first pages could have been a little more cool and engaging. It has a lot of sidebars from teens, relating their actual experiences (how I lost money day trading, etc.).

The only downside is that the last third of the book is about investing directly in stocks. I'd rather that they had stopped at the point where they say "investing in index funds is good."

Here's the table of contents:

And here's a sample passage that explains a good example of the power of compounding:

-----------------------------

Bottom line: I recommend the book, and will buy one for the sax player, and one for my daughter.