You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Market Opinions.

- Thread starter chinaco

- Start date

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

In 1987, there was a credit problem just before the October debacle. I believe the Germans raised interest rates somewhat unexpectedly. Since both Asian and European markets are down 1.5% to 2+% today (August 1st), the US market is going to get pounded today. That's the short term outlook.

But last year in May-June the stock market was down 8% and emerging markets were down 26%. The year finished up quite a bit. This year, the stock market has a ways to go to drop the amounts that it dropped last year. What will happen for the rest of the year is easy to predict: The markets will be volatile.

Get your asset allocation set up that you are comfortable with. No one can predict where the market will be in December or next year.

But last year in May-June the stock market was down 8% and emerging markets were down 26%. The year finished up quite a bit. This year, the stock market has a ways to go to drop the amounts that it dropped last year. What will happen for the rest of the year is easy to predict: The markets will be volatile.

Get your asset allocation set up that you are comfortable with. No one can predict where the market will be in December or next year.

yona

Dryer sheet aficionado

- Joined

- Jun 23, 2007

- Messages

- 45

The HK market dropped much more than 2% today (and I dropped 4%).

In my opinion, the stock markets in HK and the US both look reasonably priced. It doesn't mean they can't go lower, but 5-10 years from now they will be higher for sure.

Saying that, I am glad I don't own any bank stocks now. These mortgages and derivatives assets don't make me feel comfortable about financial institutions stocks.

In my opinion, the stock markets in HK and the US both look reasonably priced. It doesn't mean they can't go lower, but 5-10 years from now they will be higher for sure.

Saying that, I am glad I don't own any bank stocks now. These mortgages and derivatives assets don't make me feel comfortable about financial institutions stocks.

markets are hovering just above the 200 day moving average lines. whole thing depends on the mortgage problems and how they will affect the economy. could be 1998 all over again where markets dropped 20% - 50% from the peak and still ended the year up. could be like 1987 where they dropped and didn't regain the losses until 1990 or so.

problem is that there is so much leverage that when these mortgage funds go belly up or they get a margin call people may have to sell other investments as well to come up with the cash

problem is that there is so much leverage that when these mortgage funds go belly up or they get a margin call people may have to sell other investments as well to come up with the cash

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

I think a lot of the bad news is already priced in, which is why we're no longer at 14,000. There could be further capitulation, but the support level of the Dow seems to be 13,000, and I don't see it going down below there...........

A LOT has to do with Bernanke and how the mortgage thing shakes out............

A LOT has to do with Bernanke and how the mortgage thing shakes out............

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Doesn't look like 200 day MA will hold for S&P500

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Another sucking day. Down 284 points.

VaCollector

Full time employment: Posting here.

- Joined

- May 12, 2007

- Messages

- 549

....the support level of the Dow seems to be 13,000, and I don't see it going down below there...........

After today, only 182.15 more points to lose and we'll be testing your theory......next week should be very interesting, huh?

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm pretty sure we're headed down.

A lot.

I'm still almost half in cash, and have been for about 4 months now.

After spending 2 days looking over the offerings and prices after all this mayhem, i'm still not seeing any great bargains.

But I think we will.

A lot.

I'm still almost half in cash, and have been for about 4 months now.

After spending 2 days looking over the offerings and prices after all this mayhem, i'm still not seeing any great bargains.

But I think we will.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

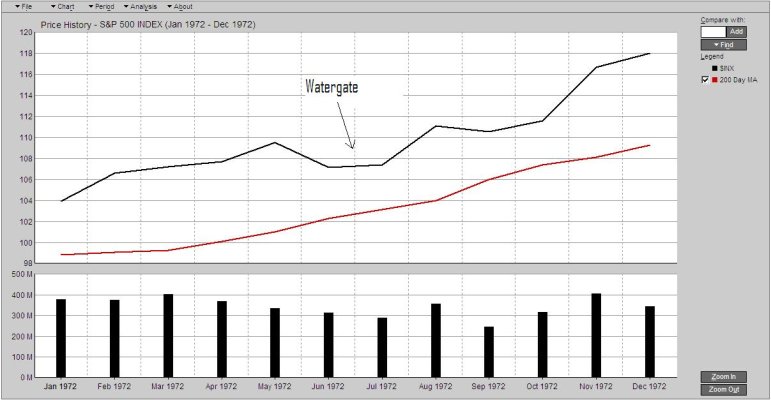

Is this 1987 ... or is it 1973-74 ... or is it like blah-blah. The answer you didn't want is that there is no way to tell. The future depends on events yet to happen. If you look at 1973-74 we had Watergate, oil embargo, recession, inflation, etc. Could these events be predicted in advance? Could one look back at the 200 day moving average and predict Watergate?

Now if you want my opinion, I'm sticking to my planned asset allocation. What a dull answer. But I rebalanced in early July sensing that things were getting a little too good and will not rebalance into equities until we see a really big drop. If no drop, there is no problem as my AA is set where I want it. Personally my internal debate centers around what type of fixed income investments to have in these type of times. Ask if you really want to know .

.

Now if you want my opinion, I'm sticking to my planned asset allocation. What a dull answer. But I rebalanced in early July sensing that things were getting a little too good and will not rebalance into equities until we see a really big drop. If no drop, there is no problem as my AA is set where I want it. Personally my internal debate centers around what type of fixed income investments to have in these type of times. Ask if you really want to know

Bigritchie

Recycles dryer sheets

- Joined

- Jun 13, 2007

- Messages

- 377

I think a couple of years ago if I told someone the market would be over 13k today they would think I was nuts hehe. Large needed correction me thinks.

I would say 12kish then up to 15k!

I would say 12kish then up to 15k!

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Could one look back at the 200 day moving average and predict Watergate?

Absolutely...here ya go.

Attachments

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

CFB, nice chart -- I'm impressed. The consequenses of Watergate appeared after Nixon was in office. Looks like from your chart the market didn't have that factored in yet.

Wish I knew if this war is ultimately going to be inflationary, or if this mortgage mess will lead to deflation ... not so cute fuzzy crystal ball.

Wish I knew if this war is ultimately going to be inflationary, or if this mortgage mess will lead to deflation ... not so cute fuzzy crystal ball.

Well if it's a typical market "correction", then one would expect at least a 10% drop, which would bring the dow to 12,600 or below. So we could still have a pretty long way to go on the downside (which I expect we will see before this thing is over). Right now I am glad I rebalanced earlier this year (in February for my wife's accounts and in June for mine) and that quite a large portion of our portfolio is held in cash right now. I pared down my small cap and my junk bond holdings when I rebalanced (though I wish I had done the same with my REITs... Oh well, I will hold onto them now and keep cashing in the dividends). But these days the only thing that makes me smile when I look at my portfolio, is my Prudent Bear fund. It's finally making money...

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My crystal ball says "ask again later..."

Quite seriously though, now that we've gotten past my ability to predict Watergate retroactively, theres a difference between predicting random events in the future and the current realities of breaking key market fundamentals. Not that i'm a big chart and numbers kind of guy over the short term, but I'm a big believer in how the talking heads' yapping about the breaking of key market fundamentals affects investor psychology.

I'm still watching and waiting. If and when people become afraid, I'll continue sitting on the sidelines until they stop being terrified.

If the volatility slows down and everyone goes back to the happy dance, I might take a position or two in some beaten down sectors.

Quite seriously though, now that we've gotten past my ability to predict Watergate retroactively, theres a difference between predicting random events in the future and the current realities of breaking key market fundamentals. Not that i'm a big chart and numbers kind of guy over the short term, but I'm a big believer in how the talking heads' yapping about the breaking of key market fundamentals affects investor psychology.

I'm still watching and waiting. If and when people become afraid, I'll continue sitting on the sidelines until they stop being terrified.

If the volatility slows down and everyone goes back to the happy dance, I might take a position or two in some beaten down sectors.

Last edited:

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Short term unsure.

Long term up.

Still 100% stocks.

Down five figures.

At age 38.

2Cor521

Long term up.

Still 100% stocks.

Down five figures.

At age 38.

2Cor521

citrine

Full time employment: Posting here.

- Joined

- Mar 7, 2007

- Messages

- 984

I shifted money from my manager's equity fund at fidelity to my fidelity retirement (10K). I did however shift 3K to my AF European Growth R5.

I am thinking of shifting more into there.....any suggestions?

I am thinking of shifting more into there.....any suggestions?

Alex

Full time employment: Posting here.

- Joined

- May 29, 2006

- Messages

- 696

Personally, I will continue to add to my investments in accordance with my Asset Allocation and investment policy. If all goes well, in five years I will wake up and be FIRE'd!!! If not, I'll reevaluate then. What happens week to week, well, I'll leave that to the market timers and financial pornographers!

All I know is today was a terrific day and I bet tomorrow will be even better! Life is good, very good indeed.........

All I know is today was a terrific day and I bet tomorrow will be even better! Life is good, very good indeed.........

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think a lot of the bad news is already priced in, which is why we're no longer at 14,000. There could be further capitulation, but the support level of the Dow seems to be 13,000, and I don't see it going down below there...........

I’m pretty sure we’re headed down.

A lot.

I'm still almost half in cash, and have been for about 4 months now.

After spending 2 days looking over the offerings and prices after all this mayhem, i'm still not seeing any great bargains.

But I think we will.

Would you boys please get your stories straight so we can know what we should do?

CyclingInvestor

Thinks s/he gets paid by the post

49 and retired, 100% invested in individual equities.

Earnings steadily climbing, being adjusted further upwards.

Dividends being increased steadily on each stock

Last few months stock prices - down 6 figures, do not care, sleeping well

Short term future stock prices - do not care

Long term future stock prices - do not care

Earnings steadily climbing, being adjusted further upwards.

Dividends being increased steadily on each stock

Last few months stock prices - down 6 figures, do not care, sleeping well

Short term future stock prices - do not care

Long term future stock prices - do not care

Tadpole

Thinks s/he gets paid by the post

- Joined

- Jul 9, 2004

- Messages

- 1,434

markets are hovering just above the 200 day moving average lines. whole thing depends on the mortgage problems and how they will affect the economy. could be 1998 all over again where markets dropped 20% - 50% from the peak and still ended the year up. could be like 1987 where they dropped and didn't regain the losses until 1990 or so.

problem is that there is so much leverage that when these mortgage funds go belly up or they get a margin call people may have to sell other investments as well to come up with the cash

From Mauldin's latest newsletter:

"Pay attention to the numbers I highlight in red for January through June of 2008. The largest portion of mortgage resets is not until next year.

We have just seen $197 billion of mortgage resets so far this year. That is less than we will see in two months (February and March) of next year."

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

Good comments from everyone.

I am going to stick with my diversification and allocation strategy. Currently at about 70/28/2 Stock/Bond/Cash. My target is 60/30/10.

My primary concern is sticking with my ER time line/plans.

I am going to stick with my diversification and allocation strategy. Currently at about 70/28/2 Stock/Bond/Cash. My target is 60/30/10.

My primary concern is sticking with my ER time line/plans.

Of course this topic is impossible to predict. Market valuations are not obscene if you ask me, just not real cheap. Personally, being in the accumulation phase, I wouldn't mind an extended period of real cheap assets.

If you are in the accumulation phase, turn off the TV and keep plugging away. If you are not, I like Ha's strategy of a little put insurance.

If you are in the accumulation phase, turn off the TV and keep plugging away. If you are not, I like Ha's strategy of a little put insurance.

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Valuations have nearly nothing to do with short term market action.

Watch how people feel about it. If nervousness turns into fear, this will keep going until we have full capitulation.

Watch how people feel about it. If nervousness turns into fear, this will keep going until we have full capitulation.

or is the big bad Bear waking up?

or is the big bad Bear waking up?