HFWR

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Subtitle: Dart-Throwing With Stock-screener

Sub-subtitle: Slow Day at the Silicon Mine...

As noted above, I am stuck at w*** on Labor Day (ironic, isn't it?) with not much to do. So I've [-]pulled some stock symbols out of my ass[/-] [-]carefully constructed[/-] created a portfolio of, for lack of a better term, "value" stocks, based strictly on the output of the Yahoo Stock Screener, using the following criterii:

Market cap => $10B

P/E <= 10

PEG => 2

P/B <= 2

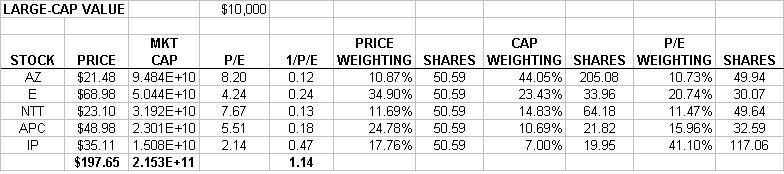

This gave me a list of five stocks: AZ, E, NTT, APC, and IP.

I then built a spreadsheet, to devise three portfolios, each based on a different weighting method: price weighting (9/1 price), cap weighting, and P/E weighting (inverse).

Then, for [-]shits and grins[/-] kicks, I created portfolios that can be tracked by anyone bored enough to do so:

http://www.bloomberg.com/apps/subscriber/webport

userid: erorg_portfolio

pw: portfolio

Sub-subtitle: Slow Day at the Silicon Mine...

As noted above, I am stuck at w*** on Labor Day (ironic, isn't it?) with not much to do. So I've [-]pulled some stock symbols out of my ass[/-] [-]carefully constructed[/-] created a portfolio of, for lack of a better term, "value" stocks, based strictly on the output of the Yahoo Stock Screener, using the following criterii:

Market cap => $10B

P/E <= 10

PEG => 2

P/B <= 2

This gave me a list of five stocks: AZ, E, NTT, APC, and IP.

I then built a spreadsheet, to devise three portfolios, each based on a different weighting method: price weighting (9/1 price), cap weighting, and P/E weighting (inverse).

Then, for [-]shits and grins[/-] kicks, I created portfolios that can be tracked by anyone bored enough to do so:

http://www.bloomberg.com/apps/subscriber/webport

userid: erorg_portfolio

pw: portfolio