Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

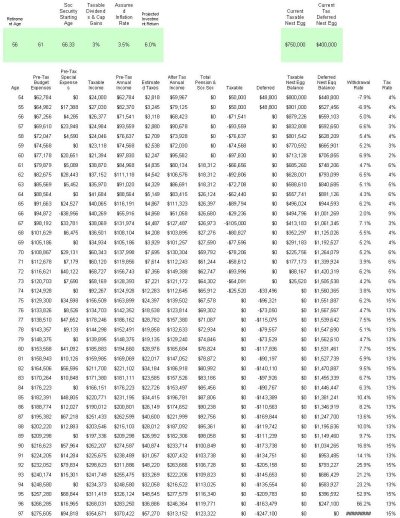

Here is my plan to retire in 2 years at 56. To view it you'll have to click on the attachment and then click again to expand it (at least I did). I have used what I consider conservative assumptions (ie, 6% return, SS at 50% of current estimates, life expectancy of 97, etc.) to increase the probability of success. I realize I'll have to re-amortize and adjust annually for market return fluctuations. We can live comfortably on this level of after tax expenses, and reduce by 30% when necessary. I don't expect anyone to analyze in detail, but anything fundamental jump out at the wizards here?