Here is what Hussman thinks, anyone see any problem with this analysis?

Quote from Hussman:

Which “inning” of the mortgage crisis are we in?

One of the fascinating aspects of Wall Street is the ability of analysts to provide opinions without the faintest backing from evidence. Among the latest topics of opinion is how far the mortgage crisis has to go. Evidently, the idea is that the recession that these analysts didn't forecast is already over, so it is time to “look across the valley” on the belief that most of the writedowns are behind us.

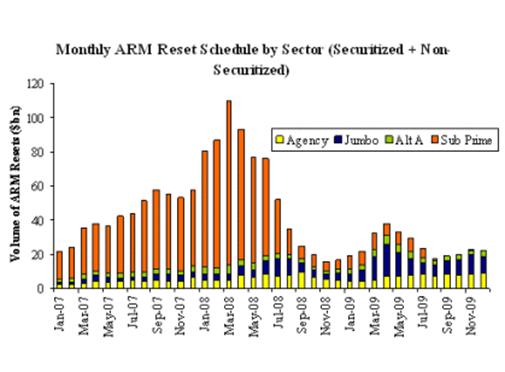

A good way to estimate where we are in the process of writedowns and foreclosures is to revisit the schedule of resets for adjustable rate mortgages.

Source: Bank of America

The chart doesn't extend out to 2010, where another spike in resets will occur in the third quarter of that year, but it is enough to recognize that resets are only now entering the heavy period. To understand the implications of this schedule, it is important to recognize the foreclosure timeline. Once a reset occurs, it takes up to 30 days for the first payment to be missed. After 90 days of attempts to catch up on missed payments, the homeowner is served with a “Notice of Default.” It then takes another 90 days with the homeowner in default for a “Notice of Trustee Sale” to be delivered, shortly after which the property is sold in a foreclosure. In short, there is generally a span of about 6 months from reset to foreclosure, which means that we have to lag the data to get the profile of anticipated loan losses.

Fortunately, only a portion of the mortgages that reset will actually go into default, but we estimate which “inning” we are currently in by calculating the cumulative amount of mortgages that will have reset at each point in time (i.e. integrating the curve), and lagging it by 6 months (roughly the span between reset and foreclosure). That produces the following profile for the cumulative losses that can be expected:

Clearly, as we enter April 2008, we appear to be quite early in the mortgage crisis, with only about a quarter of the cumulative resets having occurred. That places us near the start of the third inning, where we can expect each of the nine “innings” to be about three months in duration. Unfortunately, the next three innings (quarters) are when the heavy hitters on the opposing team will come up to the plate, as the cumulative amount of resets will surge. With that surge, loan losses and foreclosures will also predictably spike higher.

Moreover, because of the bundling, securitization*, and slicing and dicing of mortgage obligations, financial companies have little ability to take the required writedowns in advance, because they don't know yet which ones will go into default. To opine that we are in some late “inning” of the mortgage problem, without reference to the reset data, is just naïve. If anything, the probable rate of foreclosure on later resets will be higher, not lower, than the earlier resets, because those later resets represent the mortgages initiated at the peak of home prices and the trough of lending standards.

Quote from Hussman:

Which “inning” of the mortgage crisis are we in?

One of the fascinating aspects of Wall Street is the ability of analysts to provide opinions without the faintest backing from evidence. Among the latest topics of opinion is how far the mortgage crisis has to go. Evidently, the idea is that the recession that these analysts didn't forecast is already over, so it is time to “look across the valley” on the belief that most of the writedowns are behind us.

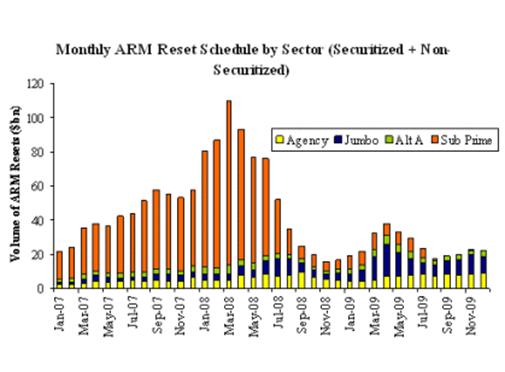

A good way to estimate where we are in the process of writedowns and foreclosures is to revisit the schedule of resets for adjustable rate mortgages.

Source: Bank of America

The chart doesn't extend out to 2010, where another spike in resets will occur in the third quarter of that year, but it is enough to recognize that resets are only now entering the heavy period. To understand the implications of this schedule, it is important to recognize the foreclosure timeline. Once a reset occurs, it takes up to 30 days for the first payment to be missed. After 90 days of attempts to catch up on missed payments, the homeowner is served with a “Notice of Default.” It then takes another 90 days with the homeowner in default for a “Notice of Trustee Sale” to be delivered, shortly after which the property is sold in a foreclosure. In short, there is generally a span of about 6 months from reset to foreclosure, which means that we have to lag the data to get the profile of anticipated loan losses.

Fortunately, only a portion of the mortgages that reset will actually go into default, but we estimate which “inning” we are currently in by calculating the cumulative amount of mortgages that will have reset at each point in time (i.e. integrating the curve), and lagging it by 6 months (roughly the span between reset and foreclosure). That produces the following profile for the cumulative losses that can be expected:

Clearly, as we enter April 2008, we appear to be quite early in the mortgage crisis, with only about a quarter of the cumulative resets having occurred. That places us near the start of the third inning, where we can expect each of the nine “innings” to be about three months in duration. Unfortunately, the next three innings (quarters) are when the heavy hitters on the opposing team will come up to the plate, as the cumulative amount of resets will surge. With that surge, loan losses and foreclosures will also predictably spike higher.

Moreover, because of the bundling, securitization*, and slicing and dicing of mortgage obligations, financial companies have little ability to take the required writedowns in advance, because they don't know yet which ones will go into default. To opine that we are in some late “inning” of the mortgage problem, without reference to the reset data, is just naïve. If anything, the probable rate of foreclosure on later resets will be higher, not lower, than the earlier resets, because those later resets represent the mortgages initiated at the peak of home prices and the trough of lending standards.