Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

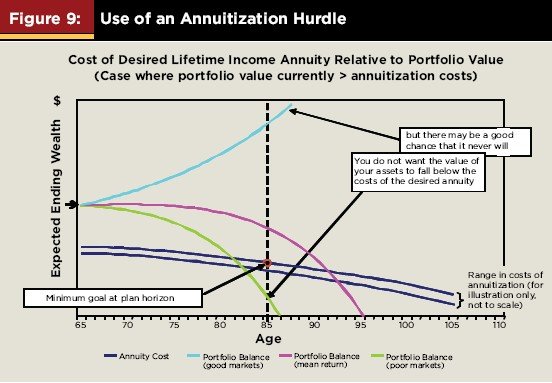

Won't end the questions I'm sure --- but the link below makes the most sense to me by far. Why buy an annuity unless and until it's clearly your best option? The later you buy the less it will cost and the less the risk of insurer(s) defaulting. And if the market takes off during your retirement, you're going to really kick yourself for buying an annuity before it made sense. This strategy let's you "have your cake (investment risk) and eat it (longevity risk) too." Here's how to know exactly when (if ever) to annuitize:

FPA Journal - Modern Portfolio Decumulation: A New Strategy for Managing Retirement Income

Brilliant IMO...

FPA Journal - Modern Portfolio Decumulation: A New Strategy for Managing Retirement Income

Brilliant IMO...

Attachments

Last edited: