You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

To those already retired

- Thread starter Florida

- Start date

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I wonder where you're going with this question......

Folks who are worth more today than when they ER'd will no doubt have some special circumstance such as pensions that cover all expenses, investments that are completely avoiding the current downturn, inheritance, insurance or legal award, etc.

Folks who are worth more today than when they ER'd will no doubt have some special circumstance such as pensions that cover all expenses, investments that are completely avoiding the current downturn, inheritance, insurance or legal award, etc.

OAG

Thinks s/he gets paid by the post

Adjusted for Inflation or unadjusted? If adjusted for inflation a link to your desired calculator would be nice and keep responses level. Also be nice to specify what Net Worth IYO is, since we have never been able to get beyond "it depends"!

shotgunner

Full time employment: Posting here.

- Joined

- Jun 18, 2008

- Messages

- 534

I would think the vast majority of Americans whether ER'd, Retired or still working would have a lower net worth today than they did in the last few years. Given the severe decline in real estate and equities most averyone has been affected. I think for most the question today is how much is enough, not how much.

RonBoyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

RonBoyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

A little less, but not by much. We bought the house before the big run-up in prices, and it's still worth (I think) more than what we paid for it in constant dollars. With inflation, it's probably - that could be wishful thinking - still gained a little bit but not much. At worst I am certain we could sell for what we paid.

The job I started last summer has just about paid enough to recoup the losses in other accounts and will certainly do so in a few more months.

But we do have a COLA'd pension. So roughly the NW is the same as at retirement.

The job I started last summer has just about paid enough to recoup the losses in other accounts and will certainly do so in a few more months.

But we do have a COLA'd pension. So roughly the NW is the same as at retirement.

dm

Full time employment: Posting here.

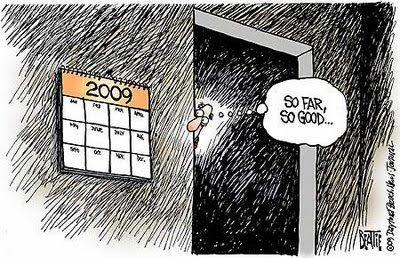

I retired October, 2007. What do you think?

FinallyRetired

Thinks s/he gets paid by the post

- Joined

- Aug 1, 2002

- Messages

- 1,322

1% less than several years ago. That shows you how conservative I've been. A lot of my income is pension based, and I moved the bulk of my funds into CDs and other fixed income investments averaging around 5%, so my stock holdings were responsible for burning through those 5% gains.

Feels pretty good right now, but didn't feel so good when everyone else was making double digit yearly gains and I was sitting on my CDs.

Oh, that doesn't include home equity, since I didn't count that on the way up, nor am I counting it on the way down. Still well above water on my two homes, but my home equity is down maybe 30-40% from the peak, along with most everyone else.

Feels pretty good right now, but didn't feel so good when everyone else was making double digit yearly gains and I was sitting on my CDs.

Oh, that doesn't include home equity, since I didn't count that on the way up, nor am I counting it on the way down. Still well above water on my two homes, but my home equity is down maybe 30-40% from the peak, along with most everyone else.

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Unless your 100% cd's, your more than likely down. I'm not 100% cd's.

CyclingInvestor

Thinks s/he gets paid by the post

I retired in Oct 2006, and keep 100% in individual stocks, so my net worth is substantially lower.

However, my dividend income (which is what I live on), is up over 20% (PG $1.24 -> $1.60, KO $1.24 -> $1.64, JNJ $1.50 -> $1.84, MMM $1.84 -> $2.04, SYY $0.68 -> $0.96, EMR $1.05 -> $1.32, etc). These dividends look secure to me unless economic conditions get substantially worse, so the drop in market prices is pretty much irrelevent to me. The slowdown in profit growth is unwelcome, because dividend increases will be smaller (or even skipped) this year, but recessions are an expected part of the economic cycle.

However, my dividend income (which is what I live on), is up over 20% (PG $1.24 -> $1.60, KO $1.24 -> $1.64, JNJ $1.50 -> $1.84, MMM $1.84 -> $2.04, SYY $0.68 -> $0.96, EMR $1.05 -> $1.32, etc). These dividends look secure to me unless economic conditions get substantially worse, so the drop in market prices is pretty much irrelevent to me. The slowdown in profit growth is unwelcome, because dividend increases will be smaller (or even skipped) this year, but recessions are an expected part of the economic cycle.

yakers

Thinks s/he gets paid by the post

I retired October, 2007. What do you think?

OK, as I understand the market history, that *beats* my March 08 retirement. Oct 07 was, AFAIK, the market peak.

bbbamI

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

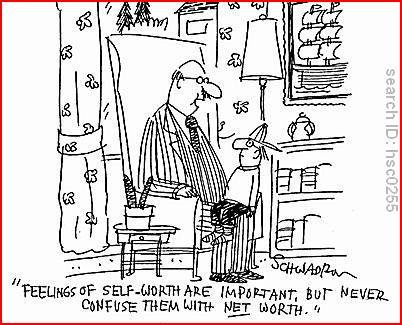

Is your net worth today higher or lower than the day you ER'd?

DH will have to get back to you on that after the market closes today as this is his first day of retirement.....

DH will have to get back to you on that after the market closes today as this is his first day of retirement.....

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Is your net worth today higher or lower than the day you ER'd?

DH will have to get back to you on that after the market closes today as this is his first day of retirement.....

What is he going to do all day?

TeeRuh

Recycles dryer sheets

Retired June 2008 so do the math. My best move was quickly getting my lump sum pension off of the sidelines and into the Market.  I mean, man, the market had dropped from 14K to 11.5K; are you kidding me! How much lower could it possibly go ...

I mean, man, the market had dropped from 14K to 11.5K; are you kidding me! How much lower could it possibly go ...

t.r.

t.r.

I mean, man, the market had dropped from 14K to 11.5K; are you kidding me! How much lower could it possibly go ...

I mean, man, the market had dropped from 14K to 11.5K; are you kidding me! How much lower could it possibly go ...bbbamI

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What is he going to do all day?

Ooooh, I don't know!

Around 7 a.m. he poked me in the side and said "hehehe....I'm retired....hehehe." I said "yes you are, now go back to sleep."

He left a little while ago on his bike...I swear I saw him dance a jig as he went to the garage......

Bikerdude

Thinks s/he gets paid by the post

- Joined

- Jul 4, 2006

- Messages

- 1,901

Is your net worth today higher or lower than the day you ER'd?

I guess I've just rearranged the deck chairs on the Titanic. While my IRA and cash assets are lower my home is modestly higher and I will start SS at the end of the year. So I guess I'm better off than I was 9 years ago although it does not feel like it.

tangomonster

Full time employment: Posting here.

- Joined

- Mar 20, 2006

- Messages

- 757

Retired August 2006....worth 25% less. It hurts, but life (and retirement) goes on. I don't expect to be back at the original level for at least seven more years---and that's only with saving 2/3 or more of my retirement income....

CuppaJoe

Moderator Emeritus

....

Folks who are worth more today than when they ER'd will no doubt have some special circumstance such as pensions that cover all expenses, investments that are completely avoiding the current downturn, inheritance, insurance or legal award, etc.

Yes, it seems this question needs explanation. Since the market hasn't closed yet today, I don't have the exact number. When I retired at the end of August '08 most of the damage in the downturn had already happened; I only look at the number I had that day. About 55% of my expenses come from my PF. At the end of the year it was higher than the original amount and basically jumps around each month, usually lower but no more than 4% lower, yet. BTW, I'm withdrawing at the 4% SWR.

M Paquette

Moderator Emeritus

I retired March 2008, and with a 60% equities/40% bonds portfolio, I'm down 28%.

It's almost rebalancing time, so soon I'll be putting more cash in the shredder...

It's almost rebalancing time, so soon I'll be putting more cash in the shredder...

CuppaJoe

Moderator Emeritus

I retired March 2008...

Congrats on one year anniversary coming up!

Is your net worth today higher or lower than the day you ER'd?

Higher.

jr

M Paquette

Moderator Emeritus

Similar threads

- Replies

- 32

- Views

- 2K

- Replies

- 65

- Views

- 9K