David1961

Thinks s/he gets paid by the post

- Joined

- Jul 26, 2007

- Messages

- 1,085

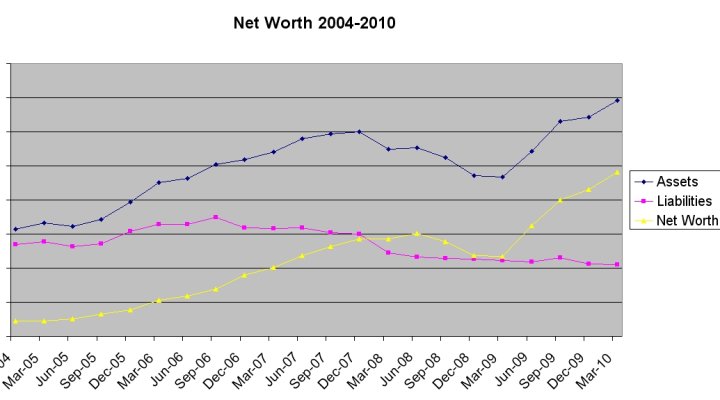

How much did your net worth drop during this recession and where are you now? Thought it’d be interesting to compare notes. Here’s mine:

High – November 2007

Lowest point since then – Feb 2009 (down 30% from Nov 2007 high)

Now – Mar 2010 – down 6.5 from Nov 2007 high

Note: I’m still working, so my net worth includes my savings from my paycheck.

High – November 2007

Lowest point since then – Feb 2009 (down 30% from Nov 2007 high)

Now – Mar 2010 – down 6.5 from Nov 2007 high

Note: I’m still working, so my net worth includes my savings from my paycheck.