haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Dollar hurt by economy worries

While we have been consumed with hot weather, dress codes and such the USD has fallen out of bed. Very near parity with the CAD, back to $1.34 against the euro and $1.61 against the pound. One USD gets you only 85 yen.

There is an intersting quote in the article linked above that relates to asset prices other than currencies.

""We're seeing a disconnection as U.S. data stays weak yet risk appetite is strong. Weak U.S. data will translate into risk aversion at some point," said Tom Levinson, currency strategist at ING."

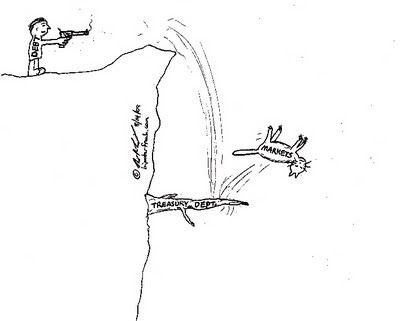

In other words, this guy Tom thinks US investors are skating on thin ice.

Ha

While we have been consumed with hot weather, dress codes and such the USD has fallen out of bed. Very near parity with the CAD, back to $1.34 against the euro and $1.61 against the pound. One USD gets you only 85 yen.

There is an intersting quote in the article linked above that relates to asset prices other than currencies.

""We're seeing a disconnection as U.S. data stays weak yet risk appetite is strong. Weak U.S. data will translate into risk aversion at some point," said Tom Levinson, currency strategist at ING."

In other words, this guy Tom thinks US investors are skating on thin ice.

Ha