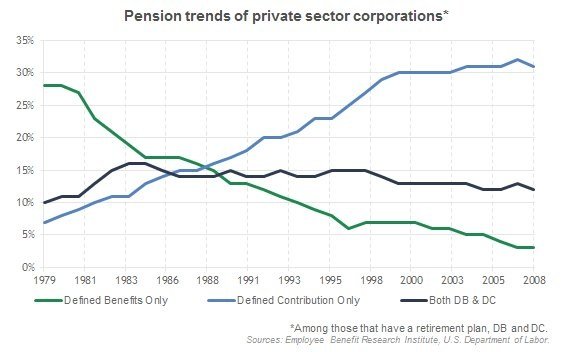

All may be true, but not sure it's fair to paint IBM alone with this brush. According to this source, private DB pensions like many of our parents had are down to less than 5% of companies in the private sector. Companies simply cannot afford to continue pensions once competitors start dropping them (and global competitors who never had them). Sad but...

FWIW, % of companies with a combination on DB + DC plans seems to held steady. Having spent a career faced with competitive pressure, cost control, future liabilities, etc. - it's not as easy as some people would like to think. And the decisions are rarely taken lightly or without understanding the impact.

If you go to the WSJ article which is linked from the initial link, it shows in a graph that 9% of plans already hold the match for a yearly "dump" to the employee. I can understand that smaller companies would need to do that. In this case IBM may set off a rash of similar action by other megacorp.

If you go to the WSJ article which is linked from the initial link, it shows in a graph that 9% of plans already hold the match for a yearly "dump" to the employee. I can understand that smaller companies would need to do that. In this case IBM may set off a rash of similar action by other megacorp.