Ex-Dividend Dates: When Are You Entitled to Stock and Cash Dividends

[FONT=Verdana,Arial,Helvetica] Have you ever bought a stock only to find out later that you were not entitled to the next cash or stock dividend paid by the company? To determine whether you should get cash and most stock dividends, you need to look at two important dates. They are the "record date" or "date of record" and the "ex-dividend date" or "ex-date."

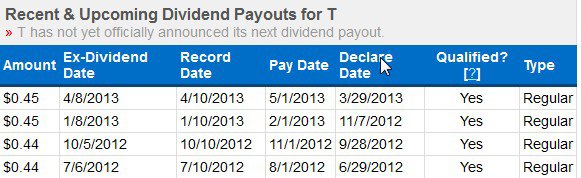

When a company declares a dividend, it sets a record date when you must be on the company's books as a shareholder to receive the dividend. Companies also use this date to determine who is sent proxy statements, financial reports, and other information.

Once the company sets the record date, the stock exchanges or the National Association of Securities Dealers, Inc. fix the ex-dividend date. The ex-dividend date is normally set for stocks two business days before the record date. If you purchase a stock on its ex-dividend date or after, you will not receive the next dividend payment. Instead, the seller gets the dividend. If you purchase before the ex-dividend date, you get the dividend. [/FONT]