haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

After reading the several threads lately about controlling taxable income to get subsidies, or at least to avoid paying surcharges I have been thinking about where I get my cash, whether these sources are compulsory or elective and how they figure into the tax that I will pay. Right now, my basic categories are (taxable) interest, qualified and unqualified dividends, royalty trust distributions, MLP distributions, SS, and RMDs. In most years I will also have net long term capital gains, and a short term gain or loss from option trading. However, these are essentially elective. I don't have to buy options, and I don't have to sell stocks.

But the rest is pushed to me, so I am stuck with the cash flows as they come, and these are more than adequate for my current frugal lifestyle. Many of these sources such as qualified dividends, royalty trust and MLP distributions are tax advantaged in the current year, though the latter two only in a deferral sense. If I had foreseen the tax picture we have now, I might have just stuck with qualified dividend payers instead of these other structures, but I don't like to make frequent changes as these always cost a lot, if only in taxes, and it is all difficult to foresee the effects. Two big sources of taxable cash on which I can't avoid or defer current taxes are RMDs and SS.

So far, I have always had to pay tax on 85% of SS. It may be that if I made avoiding this my primary goal I could occasionally slip through more cheaply. I has always seemed that some other goal was more important.

Right now my tax planning is around the twin goals of getting more cash out of my TIRA and into my Roth by making conversions, and selling fully priced stock for the smallest overall tax hit possible. These two goals are usually at odds with each other, kind of like if I do one, I really cannot do the other, unless I lower amounts. The last few years I have a temporarily abandoned the Roth conversion project, and just concentrated on selling some appreciated stock to favor stock sales. I think we will look back on current ltcg rates with awe, and wonder how we were ever so lucky. The rising tide of populism doesn't seem real hopeful to me when I consider taxation of capital. I think 15% will look very good to us sometime. If interest rates were to increase rapidly, pushing down quotes on my fixed income in my TIRA, I would stop selling stock(it would likely be hurt too) and convert more of the now cheaper fixed income to my Roth.

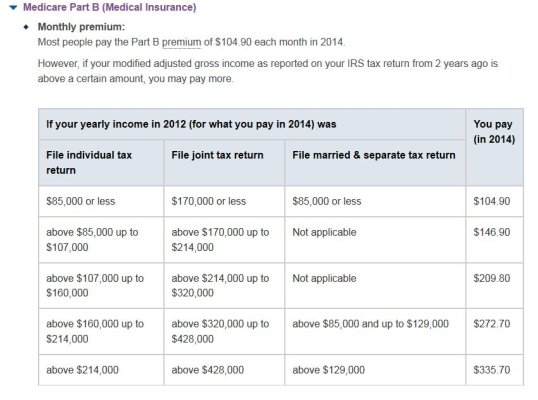

I don't stop at 0 tax on ltcgs, but I stop before triggering surcharges on Medicare. I blundered into that a few years back and was not happy. Nevertheless, I don't think I would sell something I felt was still well priced or undervalued just to increase my basis.

So anyway, this is how I currently look at my income and tax posture.

Any suggestions on improvements, or criticism or other comments?

Ha

But the rest is pushed to me, so I am stuck with the cash flows as they come, and these are more than adequate for my current frugal lifestyle. Many of these sources such as qualified dividends, royalty trust and MLP distributions are tax advantaged in the current year, though the latter two only in a deferral sense. If I had foreseen the tax picture we have now, I might have just stuck with qualified dividend payers instead of these other structures, but I don't like to make frequent changes as these always cost a lot, if only in taxes, and it is all difficult to foresee the effects. Two big sources of taxable cash on which I can't avoid or defer current taxes are RMDs and SS.

So far, I have always had to pay tax on 85% of SS. It may be that if I made avoiding this my primary goal I could occasionally slip through more cheaply. I has always seemed that some other goal was more important.

Right now my tax planning is around the twin goals of getting more cash out of my TIRA and into my Roth by making conversions, and selling fully priced stock for the smallest overall tax hit possible. These two goals are usually at odds with each other, kind of like if I do one, I really cannot do the other, unless I lower amounts. The last few years I have a temporarily abandoned the Roth conversion project, and just concentrated on selling some appreciated stock to favor stock sales. I think we will look back on current ltcg rates with awe, and wonder how we were ever so lucky. The rising tide of populism doesn't seem real hopeful to me when I consider taxation of capital. I think 15% will look very good to us sometime. If interest rates were to increase rapidly, pushing down quotes on my fixed income in my TIRA, I would stop selling stock(it would likely be hurt too) and convert more of the now cheaper fixed income to my Roth.

I don't stop at 0 tax on ltcgs, but I stop before triggering surcharges on Medicare. I blundered into that a few years back and was not happy. Nevertheless, I don't think I would sell something I felt was still well priced or undervalued just to increase my basis.

So anyway, this is how I currently look at my income and tax posture.

Any suggestions on improvements, or criticism or other comments?

Ha