Ready

Thinks s/he gets paid by the post

I see that Navy Federal Credit Union is still offering a 3% CD for a seven year term. I have never been in the navy, but it appears that if a family member has been in the Navy, they may be able to "sponsor" me. Has anyone explored trying this? Could I find a distant relative some where and ask them to sponsor me? How close do they check all this?

I'm also wondering if anyone knows what the penalty for early withdrawal is. The web site simply says there is a penalty, but doesn't state what it is. I'm guessing one year, but I can't imagine why they don't state it explicitly on the web site.

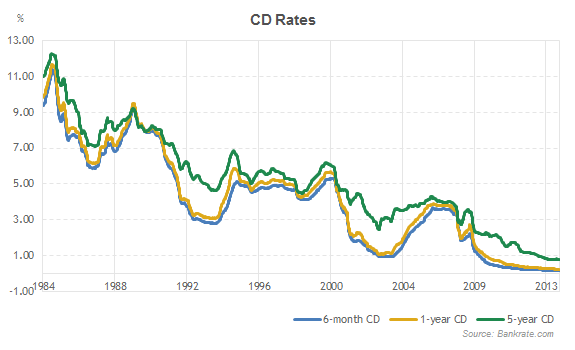

This is about the only place left that I'm aware of that is still offering a 3% CD now that the PenFed promotion is over. I have a bunch of CDs coming due this year and I'm really reluctant to open any new CDs paying less than 3%.

I'm also wondering if anyone knows what the penalty for early withdrawal is. The web site simply says there is a penalty, but doesn't state what it is. I'm guessing one year, but I can't imagine why they don't state it explicitly on the web site.

This is about the only place left that I'm aware of that is still offering a 3% CD now that the PenFed promotion is over. I have a bunch of CDs coming due this year and I'm really reluctant to open any new CDs paying less than 3%.