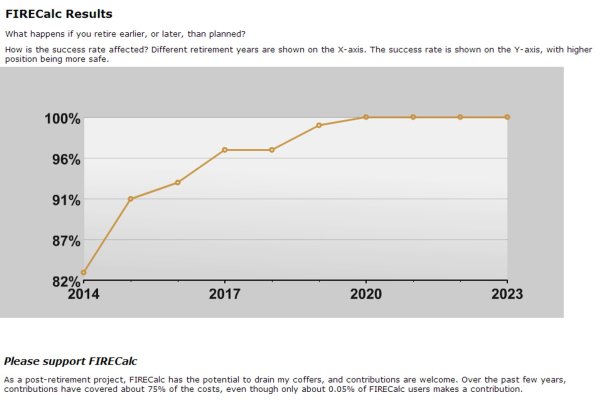

I am trying to figure out how soon I may be able to FIRE. I have a particular amount that I need to have in my investment portfolio in order for me to FIRE comfortably and with a reasonable degree of success. I relied, in part, on FIRECalc when establishing this figure. Let's say that amount equals 100 percent. Below, I have documented my investment portfolio value based on an annual basis as a percentage of the final needed investment portfolio value.

2005 12.7%

2006 17.8%

2007 23.6%

2008 25.7%

2009 20.5%

2010 32%

2011 42.5%

2012 48.9%

2013 63.3%

2014 81.3%

4/2014 83.8%

Based on the data above, or other data that I may access to, is there a way for me to estimate how long it will take me to reach 100% of my investment portfolio goal? I guess I am trying to figure out how much of a role compounding will play in the near term as I approach my final goal. The percentages above are a combination of both investment portfolio returns and savings. It seems like, on average, for the last four months the monthly increase to my investment portfolio amounts to about .8% of the total investment portfolio value. Is there an equation or a calculator that may help?

2005 12.7%

2006 17.8%

2007 23.6%

2008 25.7%

2009 20.5%

2010 32%

2011 42.5%

2012 48.9%

2013 63.3%

2014 81.3%

4/2014 83.8%

Based on the data above, or other data that I may access to, is there a way for me to estimate how long it will take me to reach 100% of my investment portfolio goal? I guess I am trying to figure out how much of a role compounding will play in the near term as I approach my final goal. The percentages above are a combination of both investment portfolio returns and savings. It seems like, on average, for the last four months the monthly increase to my investment portfolio amounts to about .8% of the total investment portfolio value. Is there an equation or a calculator that may help?