GenghisKhan

Dryer sheet aficionado

- Joined

- May 10, 2014

- Messages

- 25

It’s time to delurk and introduce myself. I’m a bit of a rarity around these parts being UK based and I am 41 years old.

My story really began in late 2007 when I woke up to how much of the financial sector in this (and other countries) works. This led to disillusionment and a realisation that if I wanted to win then it was up to me and me alone. I quickly started reading and dabbling making a few mistakes along the way.

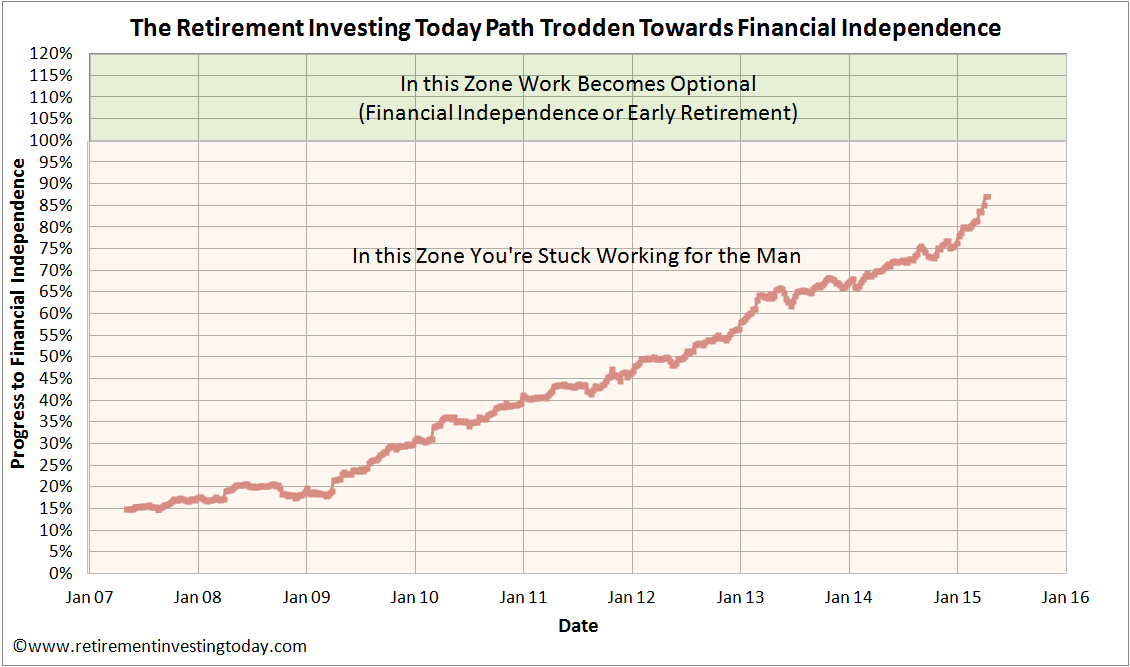

Jump forward to 2009 and my financial knowledge had improved greatly. I had a strategy and a plan to go with it. To then hold myself accountable I started a small website charting my journey and my learning which still exists today.

To the experienced on this site my strategy will sound childish and amateurish but it took me a long time to figure it all out. Crudely it’s:

I’ve only recently discovered these forums but already feel aligned with most of the beliefs. I hope I can make valued contributions going forward.

My story really began in late 2007 when I woke up to how much of the financial sector in this (and other countries) works. This led to disillusionment and a realisation that if I wanted to win then it was up to me and me alone. I quickly started reading and dabbling making a few mistakes along the way.

Jump forward to 2009 and my financial knowledge had improved greatly. I had a strategy and a plan to go with it. To then hold myself accountable I started a small website charting my journey and my learning which still exists today.

To the experienced on this site my strategy will sound childish and amateurish but it took me a long time to figure it all out. Crudely it’s:

- Do everything in my power to maximise my earnings either in current job, current company, new company, new career, own business and/or 'side hustles'. This has worked very well over the years.

- Spend the least amount needed to give the standard of living that my family and I desire. For me that has ended up being quite a small number. Looking back it surprises me how much I used to spend compared to now given my family is now happier and healthier than it has ever been. Combined with 1 it means as I write this post I am regularly saving 55% of my gross earnings. The remainder is tax and living expenses where unfortunately the taxman takes the lions share.

- Build a diversified investment portfolio that meets our own personal risk profile and includes a little bit of market valuation tilting. Rebalance it according to the defined strategy. It also shifts focus slightly from growth to income as the year’s progress.

- Minimise investment expenses and taxes that eat into the return from that portfolio.

I’ve only recently discovered these forums but already feel aligned with most of the beliefs. I hope I can make valued contributions going forward.