haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I am trying to understand the nuts and bolts of how new housing is created in the US. Not because I am on a philosophy jag, but because I am a timber investor and it seems to me that in the domestic market at least, a big purpose of growing softwood trees is to build new houses.

I don't know very much about postwar, pre 2008 housing markets, except that the main idea seemed to be to go out beyond the city blight and turn some farms into nice new housing developments. Over time downtown retail gradually gave way to suburban mall and big box retail, and now also online retail. New schools were built without many of the legacy problems of the cities, and suburban office parks even displaced much downtown office space, except in a few favored special cities. Seemed to work great, until the millenials threw a wrench into the works with some new ideas about how they wanted to live. Instead of marrying in their early twenties and setting about having babies, many are now marrying later (women average 27, men 29), delaying or forgoing childbearing and frequently not showing much desire to pack up and leave the convenience and stimulation of city living.

Where I live I am surrounded by multifamily new construction, and some infill single family and townhome construction. The zoning is complex, but true high rises are being kept in areas that were home to commercial, auto dealer, etc uses. Still, on a per dwelling basis, all of this multifamily uses more steel and concrete, and less wood than single family or townhome construction.

Teardowns and infill building are a common and high cost way to build in expensive city locations, where one or a few bungalows can be torn down and replaced with 4-5 story multi, or even nice townhomes. But the ground is very expensive, and even construction lacks the scale that suburban greenfield construction gets.

Old suburbs? Often older suburbs become crime and dope ridden messes, without the expertise of big city police departments, and often burdened by taxes that a jump to new farther out sites can lose. Still, I am personally acquainted with some pre WW2 "street car suburbs" that are still flourishing and are still very expensive with schools that are high quality by most American standards. Usually these suburbs were very expensive from the get go, or are located across some political barrier from the heavy duty crime and blight of fully urban northern industrial cities. On a recent trip my sister and I visited the house that I was born into, and the one where moved when she was born. They are both 1920s houses, and both still in good repair and in high quality suburban neighborhoods.

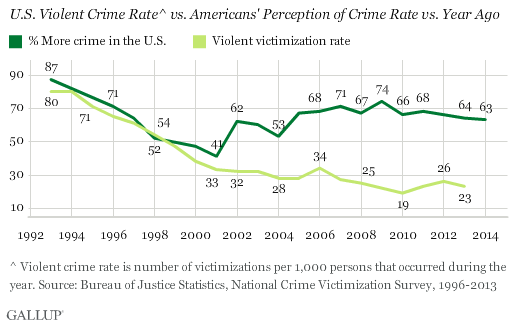

So what happens? In my mind the 2 drivers of moving away from cities are violence, and poor schools, and the interaction of these two things. Many of the school mass killings are in suburban "good neighborhoods", but day in and day out city schools are a real challenge for the teachers, and most of all for the students who have some residual hope of learning something.

Certainly here in the Seattle area, and on the San Francisco peninsula, population growth and relatively cheap cars and gasoline and tricky geography have pushed development about as far away from city center as it can go and still attract somewhat sane home buyers. It seems that the US cannot confront city crime very well, or powerful forces for the status quo in schools.

It seems like a standoff, and a resolution if one is even possible should be very interesting.

Ha

I don't know very much about postwar, pre 2008 housing markets, except that the main idea seemed to be to go out beyond the city blight and turn some farms into nice new housing developments. Over time downtown retail gradually gave way to suburban mall and big box retail, and now also online retail. New schools were built without many of the legacy problems of the cities, and suburban office parks even displaced much downtown office space, except in a few favored special cities. Seemed to work great, until the millenials threw a wrench into the works with some new ideas about how they wanted to live. Instead of marrying in their early twenties and setting about having babies, many are now marrying later (women average 27, men 29), delaying or forgoing childbearing and frequently not showing much desire to pack up and leave the convenience and stimulation of city living.

Where I live I am surrounded by multifamily new construction, and some infill single family and townhome construction. The zoning is complex, but true high rises are being kept in areas that were home to commercial, auto dealer, etc uses. Still, on a per dwelling basis, all of this multifamily uses more steel and concrete, and less wood than single family or townhome construction.

Teardowns and infill building are a common and high cost way to build in expensive city locations, where one or a few bungalows can be torn down and replaced with 4-5 story multi, or even nice townhomes. But the ground is very expensive, and even construction lacks the scale that suburban greenfield construction gets.

Old suburbs? Often older suburbs become crime and dope ridden messes, without the expertise of big city police departments, and often burdened by taxes that a jump to new farther out sites can lose. Still, I am personally acquainted with some pre WW2 "street car suburbs" that are still flourishing and are still very expensive with schools that are high quality by most American standards. Usually these suburbs were very expensive from the get go, or are located across some political barrier from the heavy duty crime and blight of fully urban northern industrial cities. On a recent trip my sister and I visited the house that I was born into, and the one where moved when she was born. They are both 1920s houses, and both still in good repair and in high quality suburban neighborhoods.

So what happens? In my mind the 2 drivers of moving away from cities are violence, and poor schools, and the interaction of these two things. Many of the school mass killings are in suburban "good neighborhoods", but day in and day out city schools are a real challenge for the teachers, and most of all for the students who have some residual hope of learning something.

Certainly here in the Seattle area, and on the San Francisco peninsula, population growth and relatively cheap cars and gasoline and tricky geography have pushed development about as far away from city center as it can go and still attract somewhat sane home buyers. It seems that the US cannot confront city crime very well, or powerful forces for the status quo in schools.

It seems like a standoff, and a resolution if one is even possible should be very interesting.

Ha