nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

So it never rains......as they say. I just decided to use my defined contribution retirement account from my most recent employer to buy back into their defined benefit pension as it has a COLA and an annuity discount rate of 7%.

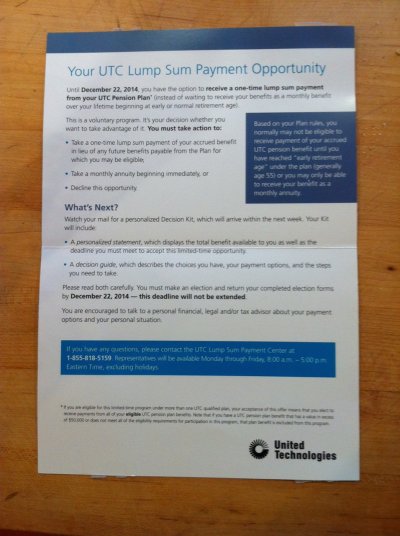

I got back home today to find a letter from United Technologies Corporation (I worked for them a long time before my last employer) offering to give me a one time lump sum instead of the small company pension I will currently get from them at age 65....so the exact opposite of what I've just done with my most recent employer. I'll be interested to see the numbers, but using the benefit which would be $500/month in 12 years time and assuming an interest rate of 4% or 5% I predict the lump sum will be around $40k.

Is anyone else a UTC employee or ex-employee who has the same offer? It will be interesting to see the exact offer which should arrive in about a week.

I got back home today to find a letter from United Technologies Corporation (I worked for them a long time before my last employer) offering to give me a one time lump sum instead of the small company pension I will currently get from them at age 65....so the exact opposite of what I've just done with my most recent employer. I'll be interested to see the numbers, but using the benefit which would be $500/month in 12 years time and assuming an interest rate of 4% or 5% I predict the lump sum will be around $40k.

Is anyone else a UTC employee or ex-employee who has the same offer? It will be interesting to see the exact offer which should arrive in about a week.