I have been playing around with TurboTax - loading in this years data. There have been a lot of updates (still not ready to efile, as there are pending state updates for me).

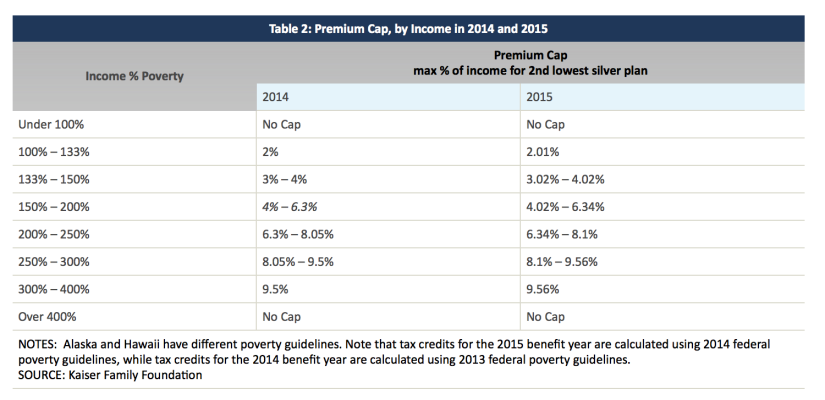

I was really caught off guard with the healthcare form (8962) causing me to lose 40% of my wife's subsidy with an increase of just $3800.00 in income. This was due to taxable investment income being higher than estimated this year (again). The subsidy calculator "applicable figure" went up significantly with the $3800 taking us from 280% of poverty level to 304% of poverty.

I couldn't believe the amount of subsidy loss and did some research on it. Found the attached article on this scenario. I also downloaded and manually did the latest 8962 form to check TurboTax, as it stated this was not a finished form yet (earlier - now finished).

I do a little (very little this year) part-time consulting - we are retired 5 years now. Have figured out that contributing those funds to my IRA will lower the subsidy loss and get me closer to the ACA website estimated subsidy. Even inputting what I think was amount of estimated income I input on the ACA website last year -on form 8962, leaves us owing 4% of the subsidy back (can't get at that info on the ACA website anymore).

This years estimated income (increased over last year ) on the ACA website - still gives the wife a higher subsidy than allowed on form 8962. Was wondering what others have seen with this scenario, and if I'm missing anything. I am VA and don't qualify for any ACA subsidy, but still have to buy off the ACA website, as the VA doesn't normally cover emergency medical care in non-VA facilities.

[Mod note - exchanging pdf for link to same article] The Obamacare Tax Shock That Could Have You Pulling Your Hair Out

I was really caught off guard with the healthcare form (8962) causing me to lose 40% of my wife's subsidy with an increase of just $3800.00 in income. This was due to taxable investment income being higher than estimated this year (again). The subsidy calculator "applicable figure" went up significantly with the $3800 taking us from 280% of poverty level to 304% of poverty.

I couldn't believe the amount of subsidy loss and did some research on it. Found the attached article on this scenario. I also downloaded and manually did the latest 8962 form to check TurboTax, as it stated this was not a finished form yet (earlier - now finished).

I do a little (very little this year) part-time consulting - we are retired 5 years now. Have figured out that contributing those funds to my IRA will lower the subsidy loss and get me closer to the ACA website estimated subsidy. Even inputting what I think was amount of estimated income I input on the ACA website last year -on form 8962, leaves us owing 4% of the subsidy back (can't get at that info on the ACA website anymore).

This years estimated income (increased over last year ) on the ACA website - still gives the wife a higher subsidy than allowed on form 8962. Was wondering what others have seen with this scenario, and if I'm missing anything. I am VA and don't qualify for any ACA subsidy, but still have to buy off the ACA website, as the VA doesn't normally cover emergency medical care in non-VA facilities.

[Mod note - exchanging pdf for link to same article] The Obamacare Tax Shock That Could Have You Pulling Your Hair Out

Last edited by a moderator: