while in the lab indexing may do better than managed funds that does not mean they do better than where investors actually put their money since i will bet more than 1/2 the funds out there have less than just a couple of the mega funds.

Managed funds charge more management fees vs. index funds. Index funds by definition match (or lag by 0.10%) the index.

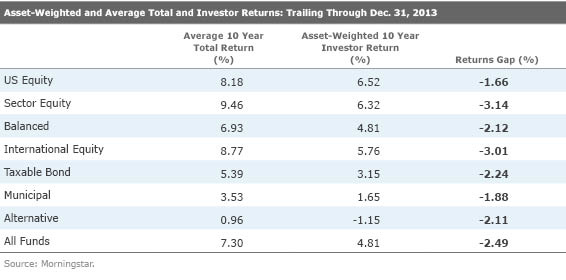

In aggregate, this means that managed funds have to underperform the index by value. This isn't lab indexing, it's unescapable math. If you add the behavorial advantage from the article (supposedly 3%), the difference only expands.

How do you square that?

in fact i have never indexed and have used the fidelity insight newsletter for 25 years. based on a 100k investment in 1987 we are at 2.2 million today. a total market fund is about 450k less .

we also did it with 10-15% less risk. the fidelity monitor had even a better record using nothing but plain old fidelity funds.

Fidelity beat benchmarks by $35 billion, but does anyone care? | Reuters

That certainly is a big difference (in a good way for you

)!

Nevertheless, "anecdote is not data", to use a silly expression. None of us (I think) are saying there aren't actively managed funds that do not outperform (Berkshire and plenty of other value funds, Wellington is also used often as an example) consistently.

What we

are saying is that the odds are firmly against you if one selects an actively managed fund instead of a passive index one. In addition, the expertise required to select a good fund for the long term is beyond most people's capabilities (including mine for sure).

In addition, there seems to (again, according to the article) a behavorial bias when using index funds. In which way the causality runs ('stable' investors select indexes, or indexes promote 'stable behavior') I don't know, but it's there apparently.

I suspect it's 'stable' investors => more indexing though, so it's not an inherent advantage to indexes. Just a hunch though, also driven by the fact that very few sales people actively push indexes as of yet. So people buying them tend to know what they are doing.

)

)