Credit card companies manage to survive bad times tho

Hope the below gives some insight.

I'd raise a couple of issues for consideration;

1) You are not lending to these borrowers directly and you don't have a security interest in the underlying loans. What you are doing is lending to Lending Club as an unsecured creditor. LC then agrees to pass along to you the performance of the underlying loans, less their fees.

That means you have two buckets of default risk. First, you're at risk if Lending Club fails. Second, you're at risk for any portfolio defaults. Here's the relevant language from the

prospectus:

Holders of any Notes do not have a security interest in the assets of Lending Club, the corresponding member loan, the proceeds of that loan or of any underlying assets of the borrower. The Notes will rank effectively junior to the rights of the holders of our existing or future secured indebtedness with respect to the assets securing such indebtedness.

In the event of a bankruptcy or similar proceeding of Lending Club, the relative rights of the holder of a Note as compared to the holders of other unsecured indebtedness of Lending Club are uncertain. If Lending Club were to become subject to a bankruptcy or similar proceeding, the holder of a Note will have an unsecured claim against Lending Club that may or may not be limited in recovery to the corresponding member loan payments.

2) In the event of a LC bankruptcy the status of your investment is highly uncertain. Whether you have a claim against LC's general assets, whether you're restricted to just the related loan assets, whether other creditors can share in those loan assets even if you have no right to other LC assets; what happens if your investment didn't get loaned out, etc are all questions that would be determined by a bankruptcy court.

3) In the event of a LC bankruptcy, institutional creditors to LC with their highly paid legal teams will be working the court system to swing all of the questions raised in point #2 in their favor. Who will argue on your behalf?

4) LC's business model relies on loan origination fees and collecting it's service fee on outstanding loan payments. As the credit cycle turns, both streams of revenue decline. That increases both the risk of an LC default at the same time portfolio defaults are rising making these loans highly pro-cyclical.

5) LC charges collection fees on defaulted loan balances of between 18% and 35%. Typical recovery rates for unsecured consumer loans is less than 35 cents on the dollar (I think), meaning that your recovery on defaulted loans are likely to be closer to zero.

6) Despite the appearance of buying into a diversified portfolio of loans, you're 100% exposed to undiversified Lending Club credit risk

-------

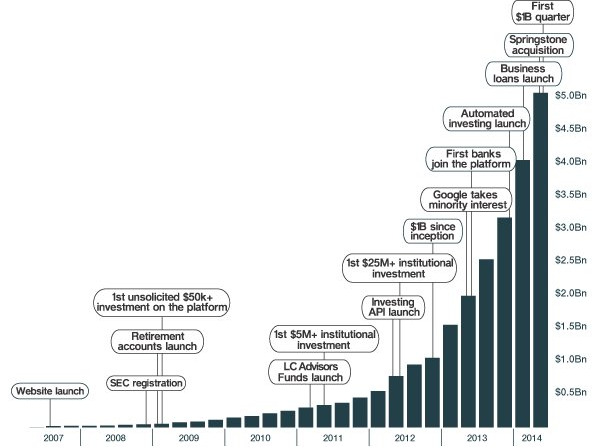

After taking a closer look at Lending Club I'd categorize a loan through their platform as

the lesser of an unsecured loan to a small high-tech start up with

projected 2016 EBITDA of just $140MM and a

2015 net loss of $5MM or an unsecured portfolio of personal consumer loans.

If LC goes down and the loan portfolio survives you likely lose.

If LC survives and the loan portfolio goes down you lose.

Only if both LC survives and the loan portfolio performs do you win.