Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

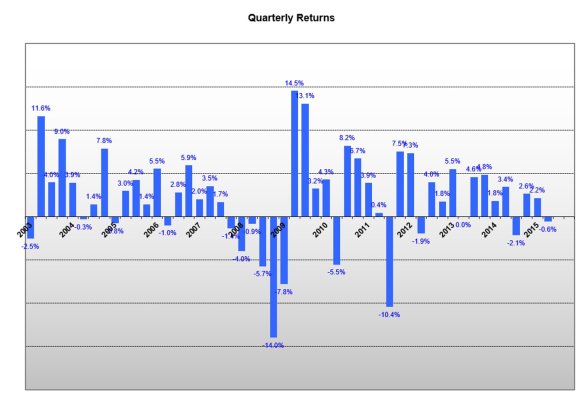

For those who like numbers/picture as much as words, here are the actual quarterly returns for

Note: It's been shown here many times that the historical difference in success rates between 40:60 and 60:40 are slight. Presumably less volatile with little effect on success FWIW.

- the past 11-12 years for a 60:40 AA,

- rebalanced using the 25/5 rule,

- with essentially no timing/trading (tweaked asset classes a few times, but never panic bought/sold anything).

Note: It's been shown here many times that the historical difference in success rates between 40:60 and 60:40 are slight. Presumably less volatile with little effect on success FWIW.

.

.