This will be the first time Ive signed up for an non employer health insurance policy. Including my pension, a small amount of money I will be paid this month for left over vacation time and my estimate of dividends and capital gains, Im right at the subsidy cliff. I mean RIGHT at it. I'm a few dollars away from getting $265/month subsidy or zero.

What would you do in this situation? I cant adjust my income level in the way of the pension or the vacation pay.

How do I accurately estimate my dividends and capital gains? They vary wildly from year to year. At least mutual fund capital gains do. If I estimate low and my income goes over the cliff is there a penalty applied to next years taxes?

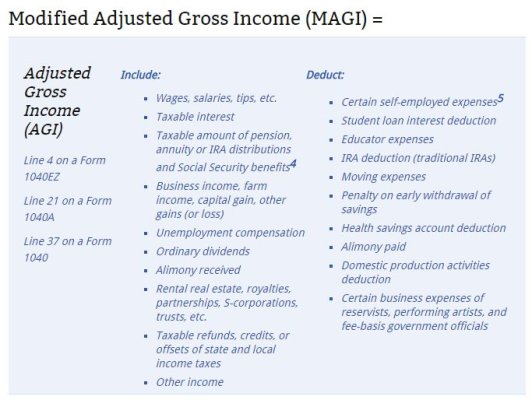

Are any deductions included in the calculation? Or are we just talking income? Also, can I wait til the end of 2016 and if my dividends and capital gains are higher than expected and are going to put me over the cliff, can I then sell some losers to write off against those capital gains and dividends?

What would you do in this situation? I cant adjust my income level in the way of the pension or the vacation pay.

How do I accurately estimate my dividends and capital gains? They vary wildly from year to year. At least mutual fund capital gains do. If I estimate low and my income goes over the cliff is there a penalty applied to next years taxes?

Are any deductions included in the calculation? Or are we just talking income? Also, can I wait til the end of 2016 and if my dividends and capital gains are higher than expected and are going to put me over the cliff, can I then sell some losers to write off against those capital gains and dividends?

Last edited: