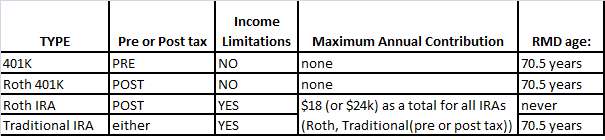

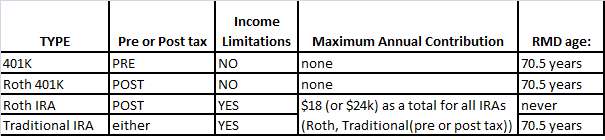

First of all, I think these are the major differences between the options listed in my title:

If my assumptions are incorrect please let me know. Thanks

AGE = 50

Spouse = 42

I normally max out my 401k and then, if we qualify, contribute to two Roth IRAs every year. My new company is offering a Roth 401k (which I never knew existed).

With this new option I am now questioning my best path given income, age, future taxable retirement income, future tax brackets, etc... Additionally, I believe I dont know enough about the tax implications for these different options. For instance, I never knew that if I did not qualify for a Roth IRA (due to income) that I could have contributed $5500 to a traditional IRA with after tax money and then converted to a Roth. Is it really that simple? It sounds kinda dumb to have the limitation if there is an easy cheat.

So, given that my spouse and I are in a period where we are making good money (right around the income limitation for IRA contributions), how do I navigate these investment options? I think taxes will increase as I near retirement, but at the same time think/hope my tax bracket may be lower in retirement.

Do I max my 401k and then, if there is investment money left, put the rest in a traditional IRA (if we dont Roth IRA qualify) and convert to a ROTH? Is this dumb?

Do I put enough in a 401K to lower my income to qualify for all or some of the Roth IRA and then put the rest in a traditional IRA and convert?

Do I put everything in a 401K?

Do I put everything in a Roth 401K.......

So confused (seriously),

Kevin

Kevin,

In essence whether to contribute tax-deferred or tax-free is a tax rate play.

IF your tax rate in retirement is expected to be less than it is when you are earning then tax-deferred is preferred... if not, then tax-free.

Look to your 2015 tax return to get your current marginal tax rate... marginal is your tax bracket or what you paid on your last $100 of income. I suspect you are probably near the top of the 15% bracket or perhaps just into the 25% bracket. Then do a tax return as if you were retired (including pension, SS, etc) and see what tax bracket you expect to be in. If your current tax bracket is higher, then you would be well off to save tax-deferred (401k or tIRA).

If your tax bracket in retirement is 15% and your current tax bracket is 25% then you might do enough tax-deferred savings to bring you back into the 15% bracket and then tax-free after that.

Also, be aware that if you already have pre-tax money in a tIRA then the "back-door" Roth has some issues.

Another factor influencing it is if you plan to retire before 59 1/2 then you'll want to have penalty free-access to your retirement savings unless you have a pension available to you... if you plan to retire after 59 1/2 then not an issue.

You didn't state the meaningful information to make the decision.

Basically, it boils down to whether you would pay a higher marginal rate today than you would during the withdrawal phase. Most people would pay a higher rate while working than they would while retired. There are some exceptions.

Don't forget that you can always convert your 401(k) to a Roth IRA while retired and in a lower tax bracket.

If you contribute to 401(k), then a traditional IRA is not deductible unless your income is relatively low, so that means you should not do trad IRA and should do Roth IRA.

My opinion is that a Roth 401(k) just confuses folks and makes them pay more taxes than they should.

So who should do Roth 401(k):

1. Folks who work and pay no income taxes.

2. Folks who will have huge pension and will work until age 70 or longer.

3. Folks who have huge salaries (39% tax bracket) and will be in the 39% tax bracket until they die.

In any given company, usually the Roth 401(k) benefits the folks at the C-level and no one else.

Thanks LOL! I appreciate your input on this topic. Not sure what meaningful information I missed.

It sounds like you and pb4uski are confirming that comparing your current tax rate to the anticipated retirement tax rate is the best metric. Then go with what's best. My marginal rate is 28% (but by only $5k) and I would anticipate 15% or 25% in retirement. Going by this alone it sounds like the best plan would be to max my 401k and if I qualify for a Roth IRA then put more into that. That's what my gut told me.

I did not consider the option of converting 401K to Roth in retirement. Perhaps that's a viable option for the retirement years where I am in the 15% tax bracket.

Also, you mentioned that If you contribute to 401(k), then a traditional IRA is not deductible unless your income is relatively low. My understanding is that the contribution limits for IRAs are separate and unrelated to 401k. That i can max my 401k, and if my income is < the phase-out I can contribute to a Roth IRA. What I was trying to confirm is if my income is > phase-out, can I still contribute after tax money to a traditional IRA and convert that to a Roth. This is what I think people refer to as a backdoor Roth. If I have no other tIRAs (i do have a roll over IRA, but no other IRAs than my Roths) then it sounds like this is doable. Is it as simple as this?

I quoted the replies I agreed with.

In your chart, you have one inaccuracy. There is NO LIMIT to who can contribute to a traditional IRA, the only limit is on who can claim the tax deduction on the contribution.

The math needed for the Roth vs traditional/deductible decision is based on your tax rates now, your ability to increases savings now, and when you plan on accessing money.

For example, if you think you need money before age 59.5. the 401k or Roth will have options the traditional does not.

As others pointed out, if your tax situation (for example from a Pension or SS) changes your retirement tax rate, you need to include all this information into decision.

So if you focus on what you know, HERE and NOW, without regard to accessing money in future (how much you need when at what tax rate), here is the information/calculation to make decision NOW. I think CPAs can help with situations like this- do you have a good CPA?

1) What is your gross income?

2) What is your adjusted gross income?

3) What is your taxable income?

4) what is your marginal tax rate?

5) Do you and wife both work?

6) Do you both have access to a 401k? Do both have access to a Roth 401k? Do you each have a match?

7) What was gross contribution to each 401k in 2014? In 2015? YTD in 2016?

8) What was gross contribution to Roth IRAs in 2014? In 2015? YTD in 2016?

The basic process for financial planning is always take inventory of your current situation now.

There is an independent process to set goals for short, mid and long term goals.

Goal setting and taking inventory are independent of one another- linking the two should NOT be done until you are much further along in process.

Questions 1-8 begin the inventory process

Goal setting-

what do you need to accomplish to have a fulfilled life and be happy?

what will make you happy next week?

on Dec 31, what will make 2016 memorable?

what do you need to accomplish short term in life- both bad things (like needing a new car) and good things (paying off a mortgage or taking a vacation)?

what do you need to do mid term (such as kids college)?

What do you expect to accomplish long term (start a business, retire, move somewhere).

FYI- You gave partial information to give partial answers.

For example if you are $5000 over the 28% bracket, can you save $5000 more to a traditional 401k- for example stop using Roth IRA and add $5000 more (or whatever you are over 28% bracket cap for married filing jointly- I forgot to add filing status to list of 8 questions as I assumed it without asking). This would create "more money" because $5000 in Roth is like $6400 in 401k- meaning you could add $6400 to 401k and take home pay would be same as $5000 in Roth. Then once 401k has you in 25% tax bracket, ask yourself same questions-

you are now in 25% bracket

gross income and lifestyle choices are in 28% tax bracket

and ask yourself the questions again- you might make different financial choices in 25% bracket because you know you will be in 28% bracket later.