Age: 49

Wife Age: 57

Pension at 65: $5.4K (no annual increase)

Wife Pension at 65: $12.5K (no annual increase)

SS at 65: $21.3K

Wife SS at 65: $23.6K

Part Time Job til 65: $35K/Year

Wife Works til 65: $60K/year

Only place to buy Healthcare is through company Retiree plan: $20K/yr

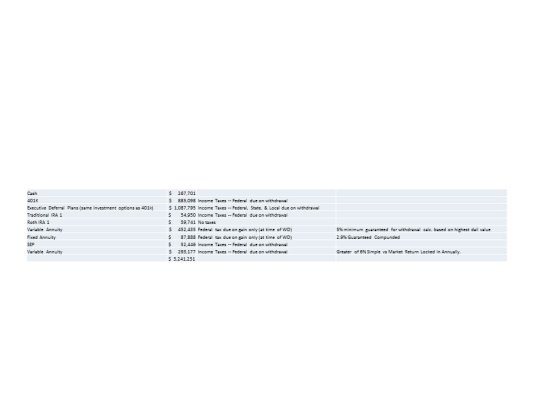

Retirement Savings: $3.25M (various different types of accounts)

Annual Expenses, including HC: $190K

There are a million other details I can provide and I am sure I need to do so to get good insights from the collective wisdom of the board. But I thought I would provide some basics to get things started. Please let me know what else to add.

I look forward to learning from all of you.

Would like to retire on 12/31. I will be just shy of 50 then. Call it 50.

Thanks in advance.

Wife Age: 57

Pension at 65: $5.4K (no annual increase)

Wife Pension at 65: $12.5K (no annual increase)

SS at 65: $21.3K

Wife SS at 65: $23.6K

Part Time Job til 65: $35K/Year

Wife Works til 65: $60K/year

Only place to buy Healthcare is through company Retiree plan: $20K/yr

Retirement Savings: $3.25M (various different types of accounts)

Annual Expenses, including HC: $190K

There are a million other details I can provide and I am sure I need to do so to get good insights from the collective wisdom of the board. But I thought I would provide some basics to get things started. Please let me know what else to add.

I look forward to learning from all of you.

Would like to retire on 12/31. I will be just shy of 50 then. Call it 50.

Thanks in advance.

Last edited: