Huston55

Thinks s/he gets paid by the post

As is likely true with most E-R.org members, reading this WSJ article reinforces my plan to stick to a predefined AA & WR. Although, I do admit to always gobbling up articles about market trends, where prices stand historically and, of course, there the markets might be going based on all that tea leaf reading. I suppose it’s my version of Financial Porn.

Anyway, below are some excerpts & a link. WSJ allows some free reads, after which a subscription is required so, apologize in advance if the link doesn’t get you the whole story. But, I think you can get the gist from the excerpt & chart. (Mods: Pls ensure I’m not violating any copyright rules with this excerpt. )

)

I’m interested in how financial forecasts, market pricing (CAPE, etc.), politics, or whatever guide your investment strategy, if they do at all. As for me, as stated above, I’m pretty much a buy & hold to my predetermined AA & WR, with the commensurate or

or  that accompanies the results.

that accompanies the results.

https://www.wsj.com/articles/wall-streets-2017-market-predictions-pathetically-wrong-1511474337

Wall Street’s 2017 Market Predictions: Pathetically Wrong

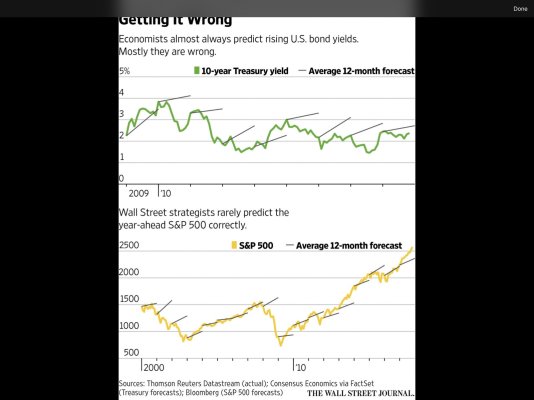

Forecasting is difficult, but this year showed exactly how pointless it can be: Markets performed opposite of virtually all predictions

We all like to remember our successes and forget our failures, and finance is no different. As investors’ inboxes once again become clogged with annual outlooks from Wall Street’s scribblers, there is little admission of the nearly universal failure to predict what happened this year—even though the things the analysts missed are much more interesting than their forecasts.

There are two big lessons to learn from the mistakes of the year-end crystal-ball gazing. The first is that when everyone agrees that prices can only go in one direction, it is dangerous. The second is more nuanced: We really know an awful lot less about how the economy works than we thought.

Last year almost everyone was bullish about the prospects for the “reflation trade” of higher bond yields, stock prices and the dollar, driven by rising wages and Donald Trump’s tax-cut plans.

A year on and inflation hasn’t materialized, the tax discussion is bogged down in Congress, and almost every analyst was wrong. Benchmark 10-year Treasury yields are down, not up, the dollar is down, not up, and the S&P 500 has delivered more than double the gains of even the most bullish Wall Street prognosticators...

...“It’s doubly silly,” says M&G fund manager Eric Lonergan. “You can’t predict what’s going to happen [with events] and even if you are fortuitous enough to be right, it doesn’t help you when you’re investing.”

This year has been a classic example. Analysts thought stocks would do well as Mr. Trump cut taxes and inflation picked up, while many also predicted more volatility because of the political and geopolitical uncertainty. They were wrong, at least so far, about taxes and inflation, but stocks went up anyway. They were right about political and geopolitical uncertainty, but volatility failed to appear.

The key to what went wrong for the forecasters this year was the lack of inflation, something Federal Reserve Chairwoman Janet Yellen has described as a “mystery.” As the year went on, investors became increasingly convinced that inflation would stay dormant, bringing down long-term bond yields and the dollar even as decent economic growth boosted profits and stock prices....

...Mr. Ruskin draws an interesting lesson from the failure of bond yields to pick up this year. Yields were held down by the $4-trillion pile of bonds held by the Fed, he reckons—in other words, it matters more how much the Fed holds than how much it buys or sells. Central banks have been saying for years that their bond-buying works by the size of their holding, not the flow, but investors have tended to focus on flow.

Not many of the year-ahead treatises have landed yet, but those that have almost all, once again, predict bond yields rising over the next year along with stock prices. It is tempting to regard that forecast as a contrarian indicator and bet on the opposite. But while that approach would have worked for bonds and the dollar this year, it would have meant missing out on a stunning share-price rally.

Strong consensus is a warning sign worth watching for. But the value in Wall Street’s year-end publications comes from the analysis they contain, not the prices they predict.

Anyway, below are some excerpts & a link. WSJ allows some free reads, after which a subscription is required so, apologize in advance if the link doesn’t get you the whole story. But, I think you can get the gist from the excerpt & chart. (Mods: Pls ensure I’m not violating any copyright rules with this excerpt.

)

)I’m interested in how financial forecasts, market pricing (CAPE, etc.), politics, or whatever guide your investment strategy, if they do at all. As for me, as stated above, I’m pretty much a buy & hold to my predetermined AA & WR, with the commensurate

https://www.wsj.com/articles/wall-streets-2017-market-predictions-pathetically-wrong-1511474337

Wall Street’s 2017 Market Predictions: Pathetically Wrong

Forecasting is difficult, but this year showed exactly how pointless it can be: Markets performed opposite of virtually all predictions

We all like to remember our successes and forget our failures, and finance is no different. As investors’ inboxes once again become clogged with annual outlooks from Wall Street’s scribblers, there is little admission of the nearly universal failure to predict what happened this year—even though the things the analysts missed are much more interesting than their forecasts.

There are two big lessons to learn from the mistakes of the year-end crystal-ball gazing. The first is that when everyone agrees that prices can only go in one direction, it is dangerous. The second is more nuanced: We really know an awful lot less about how the economy works than we thought.

Last year almost everyone was bullish about the prospects for the “reflation trade” of higher bond yields, stock prices and the dollar, driven by rising wages and Donald Trump’s tax-cut plans.

A year on and inflation hasn’t materialized, the tax discussion is bogged down in Congress, and almost every analyst was wrong. Benchmark 10-year Treasury yields are down, not up, the dollar is down, not up, and the S&P 500 has delivered more than double the gains of even the most bullish Wall Street prognosticators...

...“It’s doubly silly,” says M&G fund manager Eric Lonergan. “You can’t predict what’s going to happen [with events] and even if you are fortuitous enough to be right, it doesn’t help you when you’re investing.”

This year has been a classic example. Analysts thought stocks would do well as Mr. Trump cut taxes and inflation picked up, while many also predicted more volatility because of the political and geopolitical uncertainty. They were wrong, at least so far, about taxes and inflation, but stocks went up anyway. They were right about political and geopolitical uncertainty, but volatility failed to appear.

The key to what went wrong for the forecasters this year was the lack of inflation, something Federal Reserve Chairwoman Janet Yellen has described as a “mystery.” As the year went on, investors became increasingly convinced that inflation would stay dormant, bringing down long-term bond yields and the dollar even as decent economic growth boosted profits and stock prices....

...Mr. Ruskin draws an interesting lesson from the failure of bond yields to pick up this year. Yields were held down by the $4-trillion pile of bonds held by the Fed, he reckons—in other words, it matters more how much the Fed holds than how much it buys or sells. Central banks have been saying for years that their bond-buying works by the size of their holding, not the flow, but investors have tended to focus on flow.

Not many of the year-ahead treatises have landed yet, but those that have almost all, once again, predict bond yields rising over the next year along with stock prices. It is tempting to regard that forecast as a contrarian indicator and bet on the opposite. But while that approach would have worked for bonds and the dollar this year, it would have meant missing out on a stunning share-price rally.

Strong consensus is a warning sign worth watching for. But the value in Wall Street’s year-end publications comes from the analysis they contain, not the prices they predict.

Attachments

Last edited:

It is only 5% of my moneys and I refuse to "gamble" more than that on a sector bet.

It is only 5% of my moneys and I refuse to "gamble" more than that on a sector bet.