audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

From CNBC: GOP releases its final tax plan — here's what's in it

https://www.cnbc.com/2017/12/15/gop-releases-its-final-tax-plan--heres-whats-in-it.html

https://www.cnbc.com/2017/12/15/gop-releases-its-final-tax-plan--heres-whats-in-it.html

Here are some of the provisions the bill contains, according to a Republican summary:

- The proposal would maintain seven individual income tax brackets at slightly different rates: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent. The top rate would fall from the current 39.6 percent. The House originally proposed collapsing the system to four brackets, saying it would simplify the filing process. (Click here to see which bracket would apply to you https://www.cnbc.com/2017/12/15/find-your-new-tax-brackets-under-the-final-gop-tax-plan.html.) The changes would phase out after 2025.

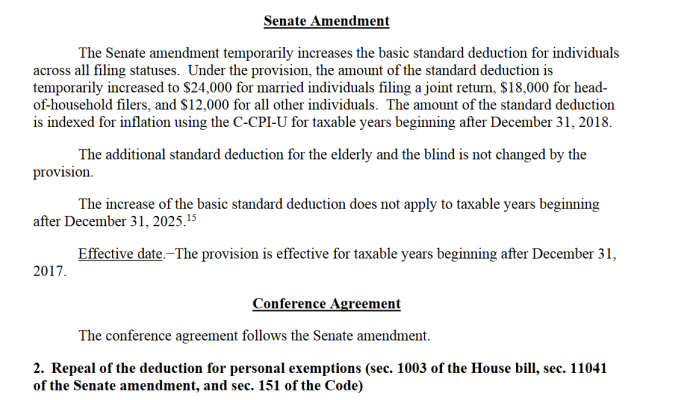

- The bill would scrap the personal exemption but increase the standard deduction to slightly less than double its current level. It would go to $12,000 for an individual or $24,000 for a family.

- It would drop the corporate tax rate to 21 percent from the current 35 percent. The change would take effect next year.

- The plan would set a 20 percent business income deduction for the first $315,000 in income earned by pass-through businesses.

- The bill would scrap Obamacare's provision that requires most Americans to buy health insurance or pay a penalty, beginning in 2019. Doing so is projected to lead to 13 million fewer people with insurance and raise average Obamacare premiums, according to the nonpartisan Congressional Budget Office.

- The plan would eliminate the corporate alternative minimum tax, which the Senate added back to its plan at the last second to raise money. House leaders and corporate groups said the tax would stifle research and development. It would also increase the exemption from the individual AMT.

- The estate tax, or so-called death tax, would remain but the exemption from it would be doubled.

- The child tax credit would double to $2,000 per child from $1,000. It would be refundable up to $1,400 and start to phase out at $400,000 in income. The tweak would end after 2025.

- The plan would limit state and local tax deductions. It would allow the deduction of up to $10,000 in state and local sales, income or property taxes.

- It will not change the mortgage interest deduction for existing homeowners. For new homes, taxpayers can deduct interest on up to $750,000 in mortgage debt, down from $1 million currently.

- Tax breaks for charitable contributions and retirement savings plans would remain.

- The bill would not include the controversial first in first out stock sales change, which sparked backlash in the investing community.

Last edited: