Ed B

Recycles dryer sheets

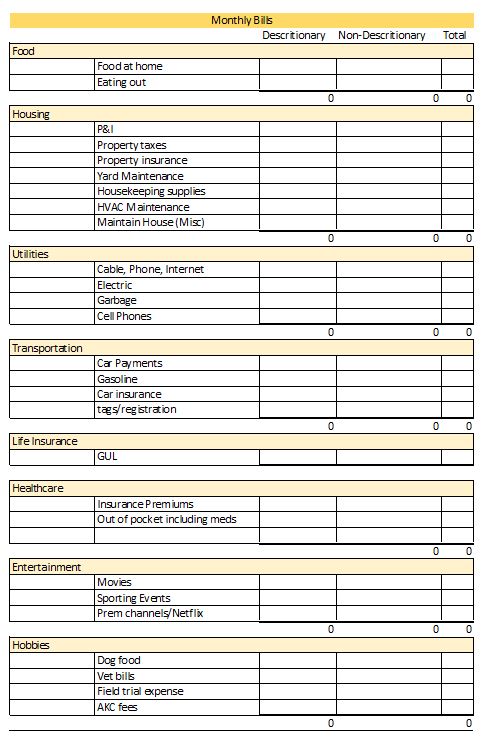

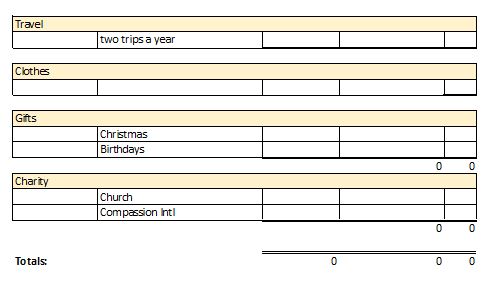

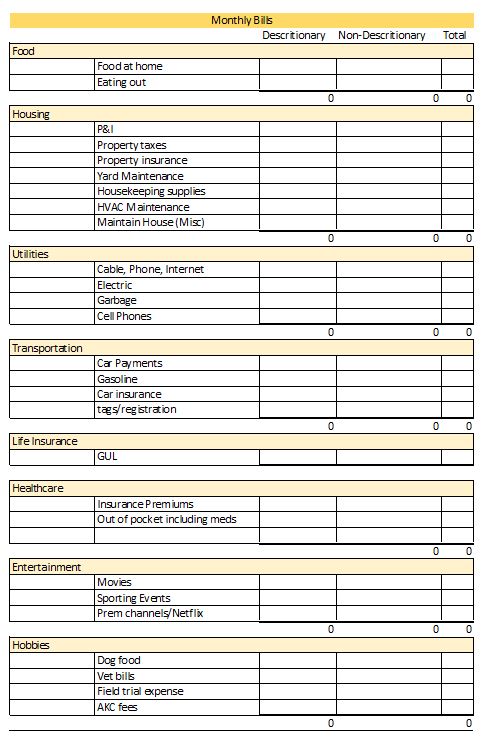

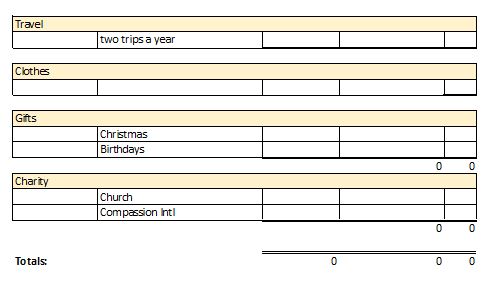

I need one more peer review. I can start the paperwork for a June 1 exit any day. I have attached two screenshots that together show my monthly budget worksheet. I put this together from several examples I have seen in this community. I break out the items under general categories with some granularity. Am I missing anything significant?

I appreciate your help.

I appreciate your help.