- Joined

- Nov 27, 2014

- Messages

- 9,212

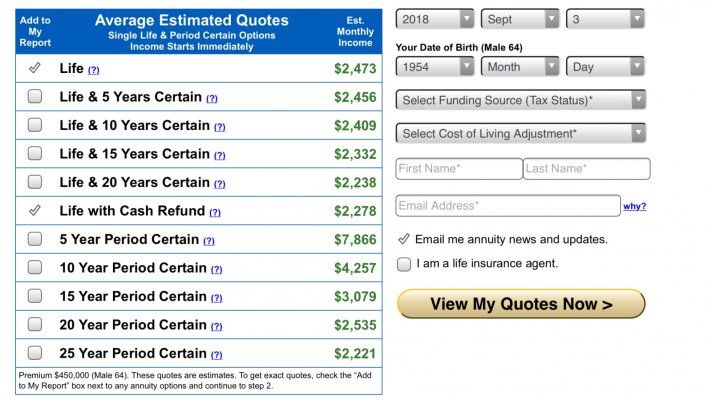

Interesting thing happened today. I'm at a point where I need to decide on my pension distribution. I can take a lump sum of about $450K or an annuity. Most people I worked with, similar to those on this forum, said to take the lump sum. When I started my planning (specific planning), after I left work, I went to Fidelity and that advisor proposed to do something tied to bonds. They called it their Core Bond Strategy and said with $500K minimum, they could cash flow about $24K per year (similar to my annuity). Interesting though that the average coupon on the bonds was only 3%, so I guess they were planning on a spend down of principle.

The interesting thing is today, I went to a highly recommended FA. Fee only and a fiduciary. Also this FA is recommended by my old boss and another friend who both were VP's at my company. It was our first meeting, but I sent them my financials ahead of time. They recommended that I take the annuity. They recommended taking a 2/3'rds survivor benefit which pays out $2,255 per month (about $27K per year). This is about a 6% withdraw rate until one of us passes.

I've been told by another guy that wanted to sell me an annuity that he couldn't do as well as the work annuity and I know that the company has fully funded their pension liability (know the CFO and I've seen the statements), so I believe that this is indeed a good annuity. But still, I was surprised by the recommendation. Overall, the basis of the recommendation was to take this and along with SS and my basic needs would be met. I would still have about $1.5M to have for cash and market investment as a hedge against inflation.

Before I go to our second meeting, I'd like to get some thought from the group on this. To be honest, it does sound good to me and DW to lock in some security, but given that this is the only FA or person to recommend this, I'm a little taken aback and would like to discuss.

The interesting thing is today, I went to a highly recommended FA. Fee only and a fiduciary. Also this FA is recommended by my old boss and another friend who both were VP's at my company. It was our first meeting, but I sent them my financials ahead of time. They recommended that I take the annuity. They recommended taking a 2/3'rds survivor benefit which pays out $2,255 per month (about $27K per year). This is about a 6% withdraw rate until one of us passes.

I've been told by another guy that wanted to sell me an annuity that he couldn't do as well as the work annuity and I know that the company has fully funded their pension liability (know the CFO and I've seen the statements), so I believe that this is indeed a good annuity. But still, I was surprised by the recommendation. Overall, the basis of the recommendation was to take this and along with SS and my basic needs would be met. I would still have about $1.5M to have for cash and market investment as a hedge against inflation.

Before I go to our second meeting, I'd like to get some thought from the group on this. To be honest, it does sound good to me and DW to lock in some security, but given that this is the only FA or person to recommend this, I'm a little taken aback and would like to discuss.