I'm always amazed at some of the members of this forum who take very low (<1%) WR when they could easily triple or quadruple it SAFELY. You can't take it with you so why leave so much $$ behind? One only gets a single go around in life.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why take a much smaller SWR than you can??

- Thread starter dtbach

- Start date

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

To be honest, I'm not sure what I would spend it on. I guess we could go out to dinner or order take out or delivery for every meal, but we enjoy cooking for ourselves.

We're happy with what we have.... for example, while I could go out and spend $35k on a new pontoon boat our current 2001 model is in very good condition and runs well so I'm inclined to keep it and continue to enjoy it.

We're happy with what we have.... for example, while I could go out and spend $35k on a new pontoon boat our current 2001 model is in very good condition and runs well so I'm inclined to keep it and continue to enjoy it.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm always amazed at some of the members of this forum who take very low (<1%) WR when they could easily triple or quadruple it SAFELY. You can't take it with you so why leave so much $$ behind? One only gets a single go around in life.

I think one reason people do it is because they are fearful about the future, and spending less now seems lower risk in case of future problems.

Another reason is old LYBM habits and not being comfortable spending more. And many don’t see a reason to.

Others are fine with passing excess on to heirs.

Me - I take a pretty healthy withdrawal% although it’s still on the conservative side and don’t worry whether I spend it all right away but it’s available on shirt notice. Over time we’ve gradually upgraded our lifestyle and spent more on experiences as well as gifted more to family and charities. That’s how I prefer to use the funds rather than letting the nest egg get even bigger.

Last edited:

CardsFan

Thinks s/he gets paid by the post

I think one reason people do it is because they are fearful about the future, and spending less now

Another reason is old LYBM habits and not being comfortable spending more. And many don’t see a reason to.

Others are fine with passing excess on to heirs.

Guilty on all counts

But I think years of LBYM's is just plain hard to break.

walkinwood

Thinks s/he gets paid by the post

Assuming that their spend allows them to live the life they want...

Some people waited past financial independence for things like pensions vesting or healthcare or for children to leave the nest.

Power to them. Their money, their life.

Some people waited past financial independence for things like pensions vesting or healthcare or for children to leave the nest.

Power to them. Their money, their life.

Another reason is old LYBM habits and not being comfortable spending more. And many don’t see a reason to.

That's a good part of it for us. We are now wealthier than we've ever been in our lives but continue to spend below our means, although we have ramped up the gifts for DW's grandnephews and grandnieces. That's just fun for DW. And we have increased our spending on restaurant meals and higher-end groceries. But other than that, not so much.

My pickup truck is 16 years old and I could write a check for a well-equipped new one, but why? There isn't a darn thing wrong with the one I have and other than a few bells & whistles I can't think of anything a new one would do that the current one can't do.

We haven't touched the IRA or TSP accounts, in part because that's part of the "safety net" for DW since if I die before she turns 66 & 4 months she's going to take a huge haircut on income. It's also part of our planning for LTC if we need it.

Cut-Throat

Thinks s/he gets paid by the post

I'm always amazed at some of the members of this forum who take very low (<1%) WR when they could easily triple or quadruple it SAFELY. You can't take it with you so why leave so much $$ behind? One only gets a single go around in life.

Well, I'm with you.....

But, I know a lot of people that Spending money actually causes "Pain" to them.... Some of them happily enjoy seeing their portfolio increase even after retirement. It's mostly an emotional reaction, and has no other answer. To each his own......

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

I'm always amazed at some of the members of this forum who take very low (<1%) WR when they could easily triple or quadruple it SAFELY. You can't take it with you so why leave so much $$ behind? One only gets a single go around in life.

My WR is not 1%, so I can't answer this. The trailing 12-month WR is 2.6%. No SS yet.

Not guilty! We're been running 4-5% annually for the last 4 years. Presumably, we'd slow down in a down market. Now, just want to have fun while we have health, energy, and, yes, money!

We like to take active trips on our own, so we need to do what we can while we are still able. No handlers or tour buses. The time for this will probably come, but not for now.

We like to take active trips on our own, so we need to do what we can while we are still able. No handlers or tour buses. The time for this will probably come, but not for now.

HI Bill

Thinks s/he gets paid by the post

- Joined

- Dec 26, 2017

- Messages

- 2,556

I would guess that the newer trucks have better safety (more air bags in more places) as well as much better headlights, and of course, better connectivity with your phone and maybe built-in gps. Nothing you'd have to have, but undoubtedly they also have a much nicer ride!My pickup truck is 16 years old and I could write a check for a well-equipped new one, but why? There isn't a darn thing wrong with the one I have and other than a few bells & whistles I can't think of anything a new one would do that the current one can't do.

Fedup

Thinks s/he gets paid by the post

I don’t even know what my WR is, take that ER.

athena53

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 11, 2014

- Messages

- 7,377

My withdrawal rate has been about 3.2% since I retired in mid-2014, so not super- low. As others have noted, I don't really need/want much more than I have and I'm already traveling beyond my wildest dreams and donating generously to charity. I'm also wary of one-off expenses. My HVAC system is only a couple of years old but cars need replacing every once in awhile (my current one is 2012), a possible large HOA special assessment is looming for dam repair, I have an ancient dental bridge that will likely fail someday, requiring at least two implants depending on the condition of the teeth on either end...Rainy days still happen!

And, if I leave a legacy for DS and his family, that will make me happy, too.

And, if I leave a legacy for DS and his family, that will make me happy, too.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

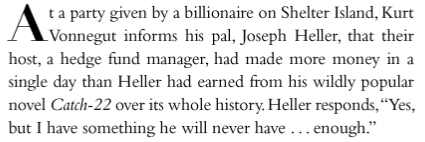

This is the first paragraph of the introduction to John Bogle's Enough. I think it is the people who have enough who are happiest, regardless of assets, SWRs, or any of the other things that we obsess about here.

@Walt34's comment is diagnostic: "My pickup truck is 16 years old and I could write a check for a well-equipped new one, but why? There isn't a darn thing wrong with the one I have and other than a few bells & whistles I can't think of anything a new one would do that the current one can't do." His pickup is enough.

We have enough, and I can testify that there is a sense of peace that comes from it. We will leave a serious seven figure estate, but I have absolutely no urges to buy a small private jet or even a Porsche.

Last edited:

W2R

Moderator Emeritus

I am on track to spend 0.53% this year which I agree, is just plain ridiculous.I'm always amazed at some of the members of this forum who take very low (<1%) WR when they could easily triple or quadruple it SAFELY. You can't take it with you so why leave so much $$ behind? One only gets a single go around in life.

It is difficult to think of anything to spend it on, that would be of value to me. Spending money on cr*p that has no value to me, would just leave me feeling empty and sad. I have been poor earlier in my life and just can't bring myself to throw money away like that.

So anyway, this is why I pay close attention to threads like the Blow That Dough thread, and why I started that Amazon thread. I think, or at least hope, that spending money for pleasure is a learnable behavior. I don't like to travel, but despite that, surely there must be some way to spend money that has value to me. Sometimes I find something! Then, whether it is costly or cheap, I buy it.

As for extravagant gifts and gargantuan donations, I prefer to leave most of that sort of thing until after my demise. To me it makes sense for that money to be my emergency money until I croak, and it will be just as useful to loved ones and charities at that time as it would be now. Meanwhile my gifts are average, substantial but not over-the-top, and I leave it at that.

OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yup. All fixed.LOL I don’t own a pickup truck and I’m darn well planning to buy a new SUV soon and I really want all those safety features plus comfortable seats.

Walt34 has the old pickup that is enough for him.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

As our retirement income has increased, and knowing that we could (should?) probably even have a higher withdrawal % (currently ~3%), I am more deliberate about spending (which includes gifting). This is more in terms of not immediately dismissing more expensive options, but instead making sure there would be value for us in upgrading to a more expensive option. Trying to do more fun things and not getting in a rut of the same old, same old.

This new car has been a bit of a drag though. We really need a new SUV. The 13 year old jeep seats are no longer comfortable, we don't do longer road trips now because of it. There are numerous safety features - back up camera, passenger lane change assist, etc. that I really value. But for some reason I haven't been that excited about going to test drive, and it's really been 3 years that we know we need a new one but haven't made much progress. But I intend to just do it, this fall. At least we have more dealer options now.

The thing is, it takes work (effort) to spend more!

DH has been helping though. He upgraded a bunch of electronics this year.

This new car has been a bit of a drag though. We really need a new SUV. The 13 year old jeep seats are no longer comfortable, we don't do longer road trips now because of it. There are numerous safety features - back up camera, passenger lane change assist, etc. that I really value. But for some reason I haven't been that excited about going to test drive, and it's really been 3 years that we know we need a new one but haven't made much progress. But I intend to just do it, this fall. At least we have more dealer options now.

The thing is, it takes work (effort) to spend more!

DH has been helping though. He upgraded a bunch of electronics this year.

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We definitely need to do some driving, because we haven't settled on even which brand yet.I bought my last car w/o a test drive and sight unseen. Just ordered one up. I did sit in the previous year model though just to see if it was comfy.

MikeWillRetire

Recycles dryer sheets

- Joined

- Apr 27, 2012

- Messages

- 216

Not guilty! We're been running 4-5% annually for the last 4 years. Presumably, we'd slow down in a down market. Now, just want to have fun while we have health, energy, and, yes, money!

.

That's my plan too!

FI_RElater

Recycles dryer sheets

- Joined

- Dec 28, 2016

- Messages

- 413

I am on track to spend 0.53% this year which I agree, is just plain ridiculous.

It is difficult to think of anything to spend it on, that would be of value to me. Spending money on cr*p that has no value to me, would just leave me feeling empty and sad. I have been poor earlier in my life and just can't bring myself to throw money away like that.

So anyway, this is why I pay close attention to threads like the Blow That Dough thread, and why I started that Amazon thread. I think, or at least hope, that spending money for pleasure is a learnable behavior. I don't like to travel, but despite that, surely there must be some way to spend money that has value to me. Sometimes I find something! Then, whether it is costly or cheap, I buy it.I was looking at the splurge thread and thinking about another new laptop. So, I browsed on Amazon but nothing jumped out at me, and my present laptop is still pretty nice and suitable for my needs.

As for extravagant gifts and gargantuan donations, I prefer to leave most of that sort of thing until after my demise. To me it makes sense for that money to be my emergency money until I croak, and it will be just as useful to loved ones and charities at that time as it would be now. Meanwhile my gifts are average, substantial but not over-the-top, and I leave it at that.

...but perhaps spend more time at places like:

Galatoire’s, Bon Ton, Tujague’s, or even Dempsey’s if something new comes out to try (not sure if Commanders Palace is always worth the cost and wait, I know you would know)... maybe to give you another idea on what to prepare yourself

you obviously know where to get the ingredients, and for us there’s some good to enjoying some different new recipes that we’ve learned to prepare

alas, we don’t have quite the selection of interesting restaurants here...(often can make something better myself, unfortunately) but we still look for interesting recipes/dishes both locally and when we travel

we’re early in the retirement (3 years in), having to wait for both pension and HC in retirement before pulling the plug, and are under 1 1/12% WR even after new vehicles, HVAC, surgery.... and haven’t started SS

.... but as most know, the big unknown is what will happen in the future, whether a prolonged downturn or health issues or what, having the buffer makes it far easier to SWAN since we know that we should have as good of a possibility (actually better) of making it through as anyone

cbo111

Full time employment: Posting here.

- Joined

- May 20, 2014

- Messages

- 979

For me, its a 100% distrust of my government, i.e., our amazing national debt that keeps on growing. Since our leaders seem to be doing nothing about it, my only recourse is to keep my personal belt tightened for the inevitable reckoning. My SWR is almost zero. We rely on modest pensions that keep us comfortable.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

For me, its a 100% distrust of my government, i.e., our amazing national debt that keeps on growing. Since our leaders seem to be doing nothing about it, my only recourse is to keep my personal belt tightened for the inevitable reckoning. My SWR is almost zero. We rely on modest pensions that keep us comfortable.

Well, if you think your long term investments are doomed to be crushed, why not enjoy some of it now, especially while you are younger, before the SHTF?

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My net WR at the moment is about 1.5%, so I'll play.

First, I worked two years after hitting a 4% FI because the job was still OK. That dropped my WR.

Then, I FIREd in February 2016 and since then have been between 90% and 100% in the S&P500. That dropped my WR even further.

Because I planned conservatively, I assumed that I had just my portfolio to live on and I would not earn any income beyond dividends. Turns out I earn non-portfolio income that equals about 1.5% in terms of WR.

Spending money is effort and work. At the very least I need to decide what to buy, which for me is difficult.

What I have is enough. While I wouldn't often describe myself as happy, I am almost always very content these days.

A pretty big factor for me is three kids who are in college or soon will be. I have saved up and set aside what I think will be enough. But I am obviously guessing and there could be large error bars on my guess. If it turns out not to be enough, I will want to add more. If it turns out to be too much, then I'll give them the excess.

When the situation becomes more clear with their college, maybe I'll loosen up a little more. We'll see.

If I don't spend enough and my kids get whatever's left and it's a lot, then I'll be OK with that too.

First, I worked two years after hitting a 4% FI because the job was still OK. That dropped my WR.

Then, I FIREd in February 2016 and since then have been between 90% and 100% in the S&P500. That dropped my WR even further.

Because I planned conservatively, I assumed that I had just my portfolio to live on and I would not earn any income beyond dividends. Turns out I earn non-portfolio income that equals about 1.5% in terms of WR.

Spending money is effort and work. At the very least I need to decide what to buy, which for me is difficult.

What I have is enough. While I wouldn't often describe myself as happy, I am almost always very content these days.

A pretty big factor for me is three kids who are in college or soon will be. I have saved up and set aside what I think will be enough. But I am obviously guessing and there could be large error bars on my guess. If it turns out not to be enough, I will want to add more. If it turns out to be too much, then I'll give them the excess.

When the situation becomes more clear with their college, maybe I'll loosen up a little more. We'll see.

If I don't spend enough and my kids get whatever's left and it's a lot, then I'll be OK with that too.

38Chevy454

Thinks s/he gets paid by the post

With a new house and detached garage I have been spending plenty in the last 18 months. But once things get down to more normal, I still plan to take 4% or so. There is not any desire to leave a large sum for the "38Chevy454 Memorial Library"

Similar threads

- Replies

- 87

- Views

- 9K

- Replies

- 87

- Views

- 9K