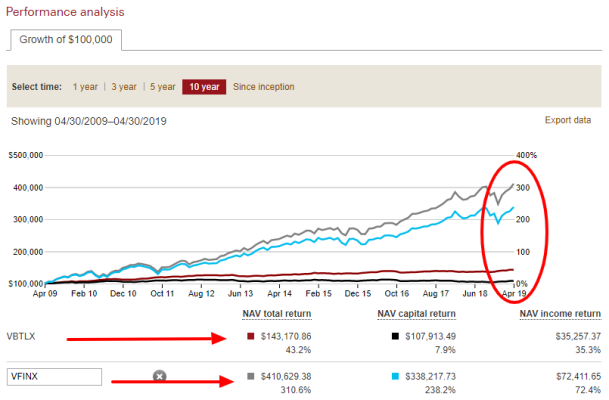

Yeah, but since that time, the S&P has rebounded. So if we use 2008 as our data point, in the past 10 years VFINX (Vanguard's S&P 500 fund) is up 310%. By comparison VBTLX is up only 43%.

View attachment 31466

So yes, the original $2.0 million investment in equities could have seen a 50% drop. But since then would have rebounded to be worth over $4.0 million today. By comparison, if $$ held in VBTLX that $2.0 million would be worth about $3.0 million today.

Additionally, point could be made that heading into 2008 the person in equities would have held much larger portfolio vs. VBTLX so would have had more dry powder available to weather that storm.

And agree, past performance is no guarantee of future performance, but it's all that we have to work with to formulate opinions.

This video maybe sums things up...